MEV - A Deep Dive

I did a research on MEV.

Hey there, before I dive in, I have to share something. This piece has been sitting in my drafts for over ten months, counting. I forgot about it, neglected it, even though it once changed my perspective and inspired me. But not anymore.

Revisiting it reminded me of why I am here, what excites me, and what keeps me going: the deep rabbit hole of MEV research.

For too long, I wandered without focus, chasing everything and nothing at once. But this moment marks a turning point. Sharing this piece is my rededication, a reminder that I have found my niche, my passion, my craft.

From here on out, expect more research, more experiments, more tools. MEV is where I am planting my flag.

To the future. Let’s dig in.

Summary

This article presents a detailed overview of Maximal Extractable Value (MEV), how it is created as a result of the transaction process from users to the blockchain, why MEV remains significant in the Ethereum ecosystem today, and the types of MEV. We also delve deeper into the nitty-gritty details of why MEV exists on Ethereum and not other blockchains, changes that came to the MEV world as a result of “The Merge”, the various risks associated with MEV today, the solutions to MEV that have been presented by the community and organizations like Flashbots – the creators of Ethereum's most prominent medium of earning via MEV. More so, we also discuss the future of MEV on Ethereum.

Introduction

To kick off, Maximal Extractable Value, popularly known as MEV, came as a result of man’s curiosity to find solutions to problems that exist in the financial markets, both the traditional and crypto markets (Decentralized Finance markets on Ethereum) have one issue, which is Frontrunning. The idea of MEV was first formalized in Flash Boys 2.0, a paper written by various Ethereum researchers on 10th April, 2019. The paper goes over the large, complex risks created by transaction-ordering dependencies in smart contracts and how traditional forms of financial-market exploitation are adapting to penetrate blockchain economics.

In the traditional finance market, frontrunning typically refers to the action of trading a security based on advanced non-public information that will affect the price of a security. It is considered a form of market manipulation and insider trading because one needs non-public information and expects a security price movement. More so, frontrunning is generally considered illegal in the traditional market, but that is not always the case, as seen in “index frontrunning“. In Index front-running, high-frequency traders try to get ahead of index funds by buying shares of a stock right before it’s added to a major index, like the S&P 500 – it’s an index that tracks the performance of 500 of the largest companies in the U.S. stock market. This announcement gives high-frequency traders a heads-up to act fast. These high-frequency traders know that index funds, which are designed to follow the index, usually buy a bunch of that stock once it’s officially added, which then drives the stock price up. Brad Katsuyama, founder of Investors Exchange (IEX), and Michael Lewis, the author of “Flash Boys,” are credited with bringing the practices of high-frequency traders to the public. High-frequency traders execute trades based on knowledge they discover seconds before the rest of the market.

Trading at high frequency has become almost instinctual in the Ethereum DeFi markets. As the transaction volume of DeFi applications has grown, the need for trading more quickly than others has skyrocketed. This allows savvy participants to arbitrage (simultaneously buy and sell) across decentralized exchanges (DEXs) and forcefully liquidate or draw down positions directly after a significant change in asset prices on trading platforms, leading to some profits. This new method of profit-taking in the Ethereum ecosystem is called maximal extractable value, or MEV for short.

MEV on Ethereum can contribute to greater levels of market participation, transparency, and efficiency. This is not quite the case for the traditional market, as certain participants who have access can reorder and submit trades in the market, thereby making it hard for new participants to enter. Before diving into what MEV is and how it is rumored to have the capacity to dramatically change the crypto ecosystem, let’s cover some foundational concepts that will help us better understand MEV. The next section goes deep into how transactions are processed on Ethereum.

How Transactions are Processed on Ethereum

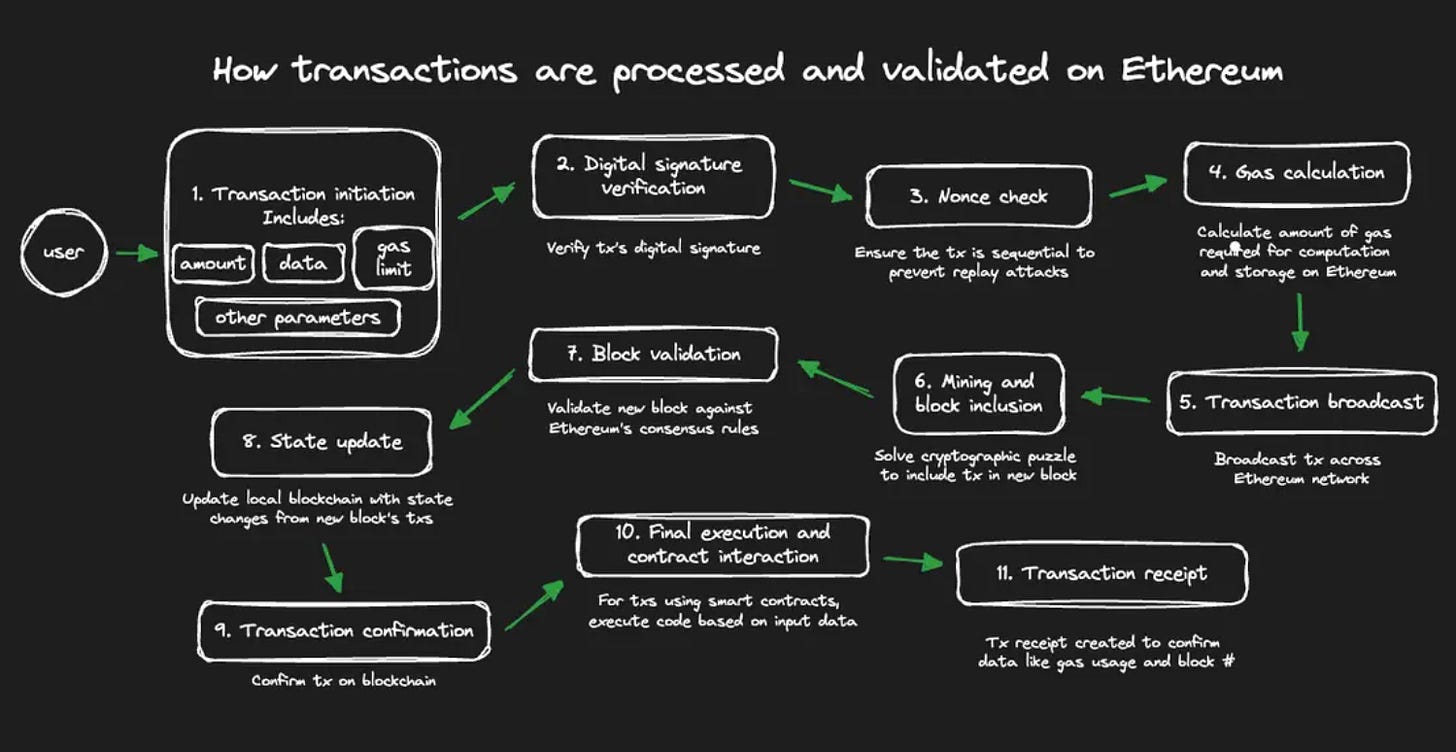

To fully understand what MEV is and how it has led to the rapid growth of the decentralized market on Ethereum, it’s important to look more closely at how transactions are processed on Ethereum. When a user initiates a transaction, it goes through several steps before it's validated, the state of the blockchain is updated, and finally, before it is finalized (This means the transaction is irreversible and has been accepted by the Ethereum network).

When a smart contract or an Externally Owned Account (EOA) initiates a transaction, it transfers tokens or executes a function on a smart contract. The request contains details like recipient address, amount of Ether (if any), and some arbitrary data, such as data to include (if interacting with the contract), gas limit, and other information.

The transaction goes through these steps:

Initiate transaction. A smart contract or account initiates a transaction.

Verify transaction signature. Nodes on the Ethereum network verify the digital signature of the transaction to confirm its validity and to ensure that it has not been tampered with during transmission.

Confirm sequence. The network checks the “nonce” to ensure that the transaction is sequential and prevents “replay” attacks (an attack whereby an attacker intercepts and manipulates data transmission on the blockchain network, which is a security threat to transactions). Nonce is the number contained within a transaction payload that keeps track of the number of transactions sent by your address.

Increment nonce. The nonce is incremented with each transaction sent from an account. The transaction also specifies a gas limit, which is the maximum amount a sender is willing to use for that transaction. Gas fees in Ethereum are paid to cover the cost of computation and storage of data on the Ethereum network.

Submit to the execution client. The transaction is submitted to an Ethereum execution client, which verifies its validity. This means ensuring that the sender has enough ETH to carry out the transaction and that they have signed it with the correct key. If the transaction is valid, the execution client adds it to its local mempool (list of pending transactions) and also broadcasts it to other nodes over the execution layer gossip network.

When other nodes hear about the transaction, they add it to their local mempool too. Advanced users might refrain from broadcasting their transaction and instead forward it to specialized block builders such as Flashbots Auction. This allows them to organize the transactions in upcoming blocks for maximum profit (MEV). One of the nodes on the network is the block proposer for the current slot, having previously been selected pseudo-randomly using RANDAO. This node is responsible for building and broadcasting the next block to be added to the Ethereum blockchain and updating the global state. The node is made up of three parts: an execution client, a consensus client, and a validator client. The execution client bundles transactions from the local mempool into an “execution payload” and executes them locally to generate a state change. This information is passed to the consensus client, where the execution payload is wrapped as part of a “beacon block” that also contains information about rewards, penalties, slashings, attestations, etc. That enables the network to agree on the sequence of blocks at the head of the chain. The communication between the execution and consensus clients is through the Engine API.

Other nodes receive the new beacon block on the consensus layer gossip network. They pass it to their execution client, where the transactions are re-executed locally to ensure the proposed state change is valid. The validator client then attests that the block is valid and is the logical next block in their view of the chain (meaning it builds on the chain with the greatest weight of attestations as defined in the fork choice rule). When a block is valid, each node updates its local copy of the Ethereum blockchain with the new state changes from the transaction in that block. The state update includes contract storage, account balances, and other data. Ethereum has a global Merkle tree, which consolidates all state data by organizing it into a hierarchical structure where each block’s state is hashed and linked, leading to a single root hash.

The block is added to the local database in each node that attests to it. The transaction can be considered “finalized”, i.e., that it cannot be reverted, if it has become part of a chain with a “supermajority link” between two checkpoints. Checkpoints occur at the start of each epoch, and to have a supermajority link, they must both be attested to by a minimum of 66% of the total staked ETH on the network. For transactions interacting with smart contracts (an EOA executing a function in a smart contract), the contract’s code is executed according to the input data provided in the transaction. The execution may involve updating the contract’s internal state, emitting events, or triggering further transactions. Finally, a transaction receipt is generated and can be inspected to confirm details such as the amount of gas used, block number, and other important data.

What Exactly is MEV?

Maximal Extractable Value (MEV) is the total amount of profit a miner (a validator, sequencer, or other privileged actor) can extract by manipulating the sequence within a block space. This means they can exclude, include, or re-order transactions from the blocks they produce. More so, MEV includes both the “conventional” profit, which is profits from transaction fees and block rewards, and the “unconventional” profit, which is profits from transaction reordering, transaction insertion, and transaction censorship within the block the miner is producing.

MEV was first applied in the context of the Proof of Work consensus mechanism and was initially referred to as “Miner Extractable Value”. This was so because in the Proof of Work mechanism, miners control inclusion, exclusion, and or ordering of blocks. Ever since “The Merge”, Ethereum transitioned from the Proof of Work consensus mechanism to the Proof of Stake consensus mechanism, validators have been responsible for the roles that were being performed by miners. The term MEV can be quite misleading, and even with the definition stated above, we still cannot precisely define what MEV exactly is. At its core, MEV has little to do with validators but has everything to do with order optimization technique. To better understand the concept of MEV, let’s take a look at the traditional finance market.

Traditional Finance Market

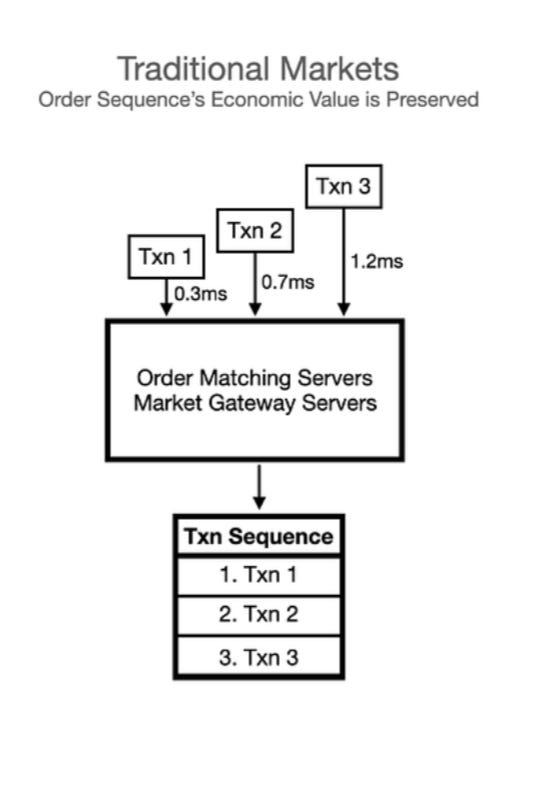

In the traditional finance market, user orders are sequenced by a trusted and regulated intermediary in the order in which they were received. This simply means orders are processed on a first-come-first serve basis.

In this financial market, after the orders are received, the order sequence is set and deterministic, and therefore, the economic value is preserved. For instance, a single trade typically begins with a user submitting an order through a brokerage firm. This order is then moved to the exchange's matching engine, which serves as the heart of the trading system. The matching engine is a system that analyzes incoming orders and connects compatible buy and sell orders based on predefined rules. The engine uses algorithms like FIFO (First-In-First-Out) to determine the order of execution, ensuring fair and efficient trade matching. Once a match is found, the trade is executed, and the exchange reports the details back to the submitting broker, who then informs the end-user of the trade completion. Traditional finance markets have a centralized checkpoint, which is either the exchange server or the Securities and Exchange Commission (SEC).

In the traditional market, orders could be manipulated before getting to the centralized checkpoint. Here, traders are able to use various means to reduce the latency between the exchange server and their own server, thereby gaining market information before other traders. Using this information, they are able to execute their own transactions at the right time for maximum economic reward. This is a high-frequency order manipulation.

Crypto Market

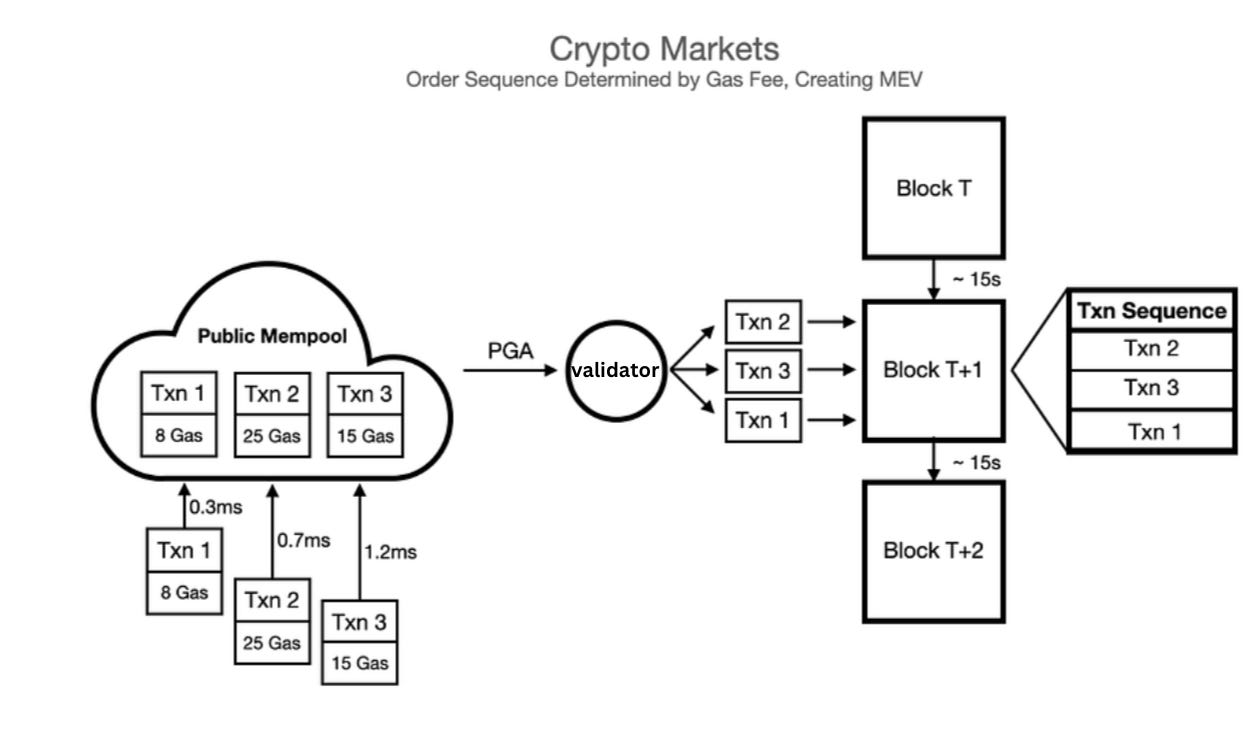

The crypto market has a different approach to the order optimization technique. As discussed above, when transactions are initiated and they are validated by the nodes in the Ethereum network, they are sent to the public mempool, and the transactions are ordered by validators through Priority Gas Auction or PGA. That means transactions with the highest paying gas get added, batched, and executed first.

In Ethereum, users express their willingness to pay for inclusion in a block through their transaction gas prices, and therefore through the fee they indicate they are willing to pay to validators. Validators, as economically rational sectors, pick the transactions with the highest gas price. The financial system built on Ethereum creates new profit opportunities such as liquidation, arbitrage, and more. These opportunities, although present, are finite and episodic, and traders compete to claim them.

Two common ways in which traders compete are frontrunning and backrunning:

Frontrunning: Rick sends a transaction tagged “ transaction A ” that is broadcast with a higher gas price than an already pending “ transaction B ” which belongs to Morty, who sent hers with a lower gas price. In this case, transaction A gets included in a block before transaction B, so that means transaction A gets mined before transaction B(eg, to snatch a Uniswap price arbitrage trade to rebalance a pool).

Backrunning: Rick sends a transaction tagged “ transaction A” which is broadcast with a slightly lower gas price than the already pending “transaction B” that belongs to Morty. So that means “transaction A” gets mined right after “transaction B” in the same block. (eg, to execute a DyDx liquidation after a price oracle update that triggers a DyDx loan to go under the required collateralization ratio).

Both frontrunning and backrunning are inefficient, and lead to negative externalities such as network congestion (i.e. p2p network load) and chain congestion (i.e. blockspace usage). We’ll discuss the risks associated with MEV in more detail later on.

But where do validators come into play in the crypto market of MEV? In theory, MEV accrues entirely to validators because they are the only party that can guarantee the execution of a transaction first. The PGA design in Ethereum allows validators to sort through the mempool to find transactions to add to the block before it is added to the blockchain.

Why MEV Exists

The concept of paying a fee, which is referred to as “gas”, before a transaction is added to a block is really genius because it gives validators the ability to choose which transaction gets picked by them and because transactions with higher gas have a higher chance of being picked. Rather than relying on gas free transactions on blockchains such as EOS leads to huge amounts of spam transactions and denial of service attacks, gas fees make it cost-intensive for blockchains to be filled with spam transactions.

It’s this same incentive that both makes Ethereum permissionless and creates MEV. This rationale causes validators to express preferences for transactions with higher gas fees over those with lower gas fees, and this drives them to seek out other means which is able to give them more profits.

It is important to note that all opportunities for validator rewards on permissionless blockchains – be it through gas fees, block subsidies, or even MEV – are equally distributed. MEV can exist on any public permissionless blockchain that relies on the self-interest of validators to gatekeep pending transactions, but it is especially prolific on Ethereum due to its account-based model and transaction execution schema.

Accounts & UXTO

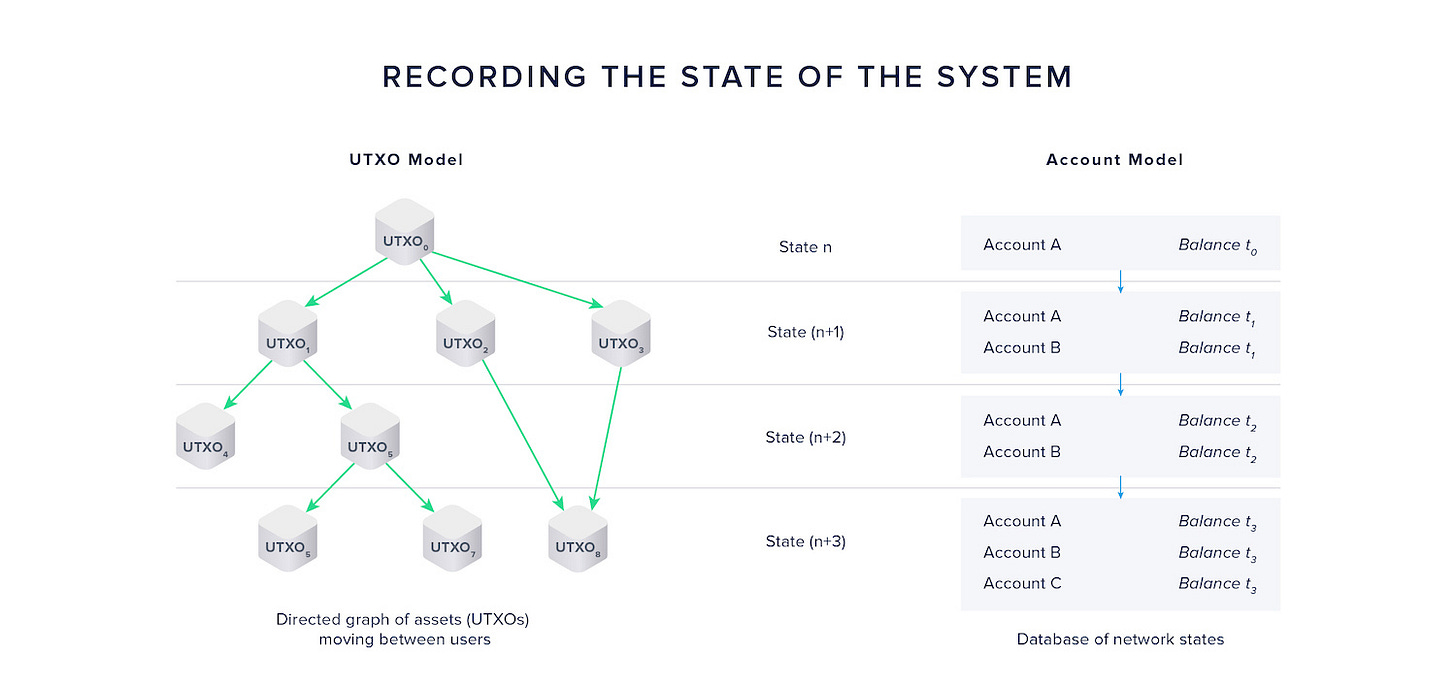

Ethereum uses the account-based model, while Bitcoin uses UTXO (Unspent Transaction Output) to keep track of user state/balances. Before we get into why MEV is prolific on Ethereum’s account-based model, it makes sense to understand what is meant by blockchain being a state machine. A blockchain is said to be a system machine when it's able to record past events and interactions.

The way past events and interactions are recorded on the blockchain is what draws a line between the account-based model and UTXO. The major difference lies in the way the bookkeeping process is handled. By bookkeeping, we mean recording the state and the transition from one state to another.

The bookkeeping in the account model works just like bank accounts, where money transfers are recorded as debits and credits in different users' accounts on the bank's ledger. For example, when Rick wants to send $5 to Morty, the bank credits or deducts $5 from Rick's account and debits or adds $5 to Morty's name in its ledger.

The same happens in account-based blockchains; only the ledger that records the users' balances is distributed among the nodes. The key point is that account-based model blockchains don't track coins but instead balance changes on users' accounts. In this model, the notion of identity is present, and one user is typically associated with a single blockchain account or address. Moreover, the account-model updates user balances globally while the UTXO model only records transaction receipts. In the UTXO model, the account balance is updated on the client side by adding up all the unspent transaction outputs (UTXOs).

Ethereum makes executing MEV transactions easier for the following reasons :

Transactions are sequential in an account-based model, meaning that changes to the balance of an account can only happen in the order transactions are included in a block. This is ideal for searchers who need to execute their transactions directly following or preceding another transaction. On Bitcoin, the UTXO model allows for the simpler parallelization of transactions in smart contracts. Multiple UTXOs used in different transactions can be processed at the same time since they all refer to independent inputs. Depending on the number of UTXOs held by an address, multiple transactions can be executed in parallel, which would theoretically make it harder for searchers to coordinate the execution of their transaction bundles.

UTXO model blockchains are way better when dealing with simple transactions that have simple logic. For instance, executing MEV opportunities by spending UTXOs before or after other transactions creates computational overhead because it requires tracking the balance of multiple new UTXOs as opposed to a single account balance, which is the case in account-based model blockchains like Ethereum. This means that complex transactions can easily be coded into the account-based model. The UTXO model(eg, Bitcoin) is meant for simple transactions like peer-to-peer payment, while the account-based model(eg, Ethereum) is able to house decentralized applications with complex logic. This is also why Ethereum has a booming DeFi ecosystem and Bitcoin does not.

Tracking spending patterns through transaction history is simpler with accounts than with UTXOs. In Bitcoin's UTXO system, new UTXOs are generated for every on-chain transaction, and wallets usually create new addresses for each transfer automatically. An observer can only link UTXOs to the same user when multiple UTXOs are used together in a transaction, which blockchain forensics firms use to try to de-anonymize Bitcoin users.

For the various reasons stated above, Ethereum has greater incentives for validators to take advantage of than the Bitcoin ecosystem. This has led Ethereum to have around 55% to 60% of the total value locked (TVL) in Decentralized Finance (DeFi). MEV on Ethereum is more transparent and accessible than other blockchains.

How MEV Works Behind the Scenes

We have gone over various concepts up until now that aided in the understanding of what MEV is, such as how transactions are processed on Ethereum, understanding order optimization techniques in the traditional finance market, and why MEV is thriving on Ethereum, to name a few. But wait. We are yet to understand the inner workings of MEV, how validators extract MEV, who searchers, builders, and relayers are, and the role they play in the MEV ecosystem. Let's dig in…

Ethereum networks are secured by a group of decentralized computers known as validators, which are able to validate and process new blocks. They are also called block producers, and they’re responsible for adding pending transactions into blocks, which are then validated by the entire network before being added to the blockchain. While the node processes this transaction, more transactions are continuously submitted. However, there is no strict guarantee that transactions will be ordered in the precise sequence in which they were submitted, as they are added to blocks based on various factors during validation.

Since each block can only contain a limited number of transactions, block producers have full autonomy in selecting which pending transactions in the mempool. While block producers by default order transactions based on PGA, the highest gas price (transaction fee) gets added to a block first before other transactions with low gas fees get added. As a result, block producers can extract additional value by taking advantage of their ability to arbitrarily reorder transactions, creating maximal-extractable value (MEV). Due to the resources and expertise required to extract MEV, it is common for block producers in blockchain networks to outsource the creation of blocks to third-party networks consisting of searchers, builders, and relayers. The next section goes into more detail, defining the role of searchers, builders, relayers, and validators in the MEV ecosystem.

The Key Actors in the MEV Ecosystem

The important actors surrounding MEV are searchers, block builders, relays, and validators.

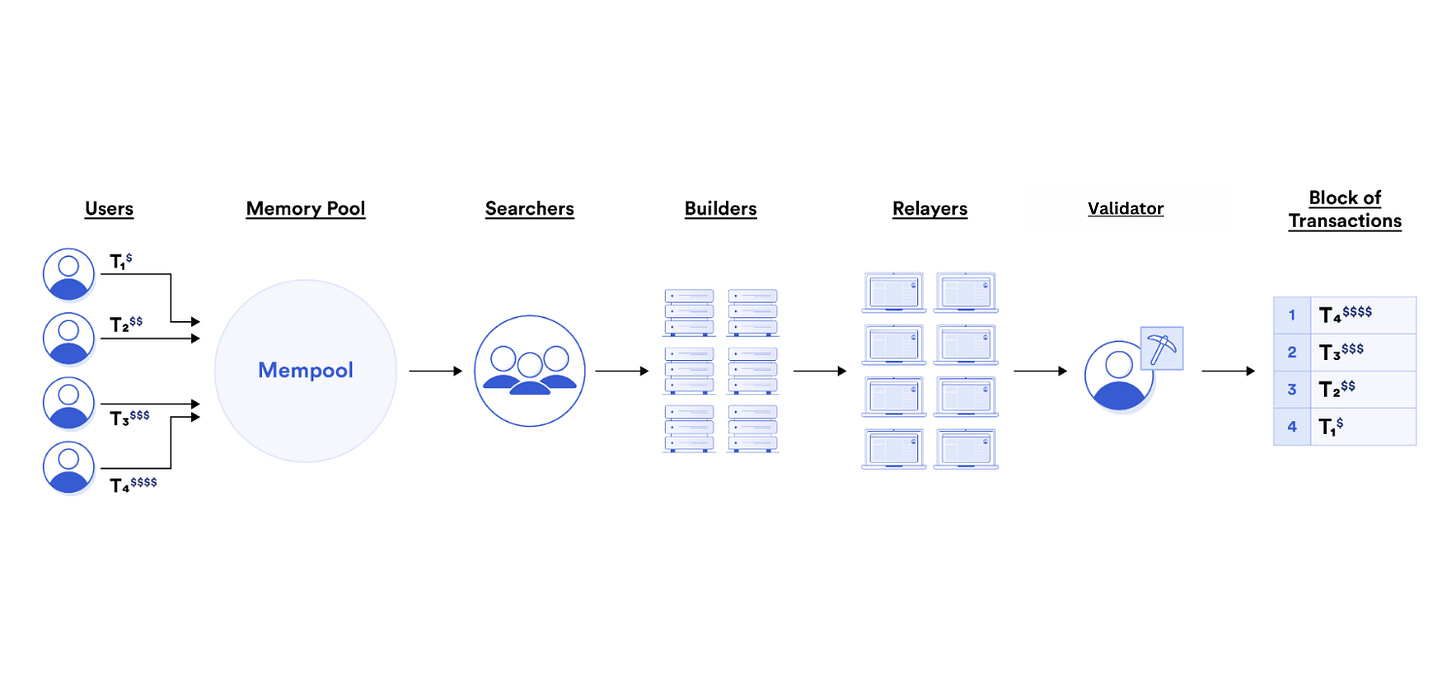

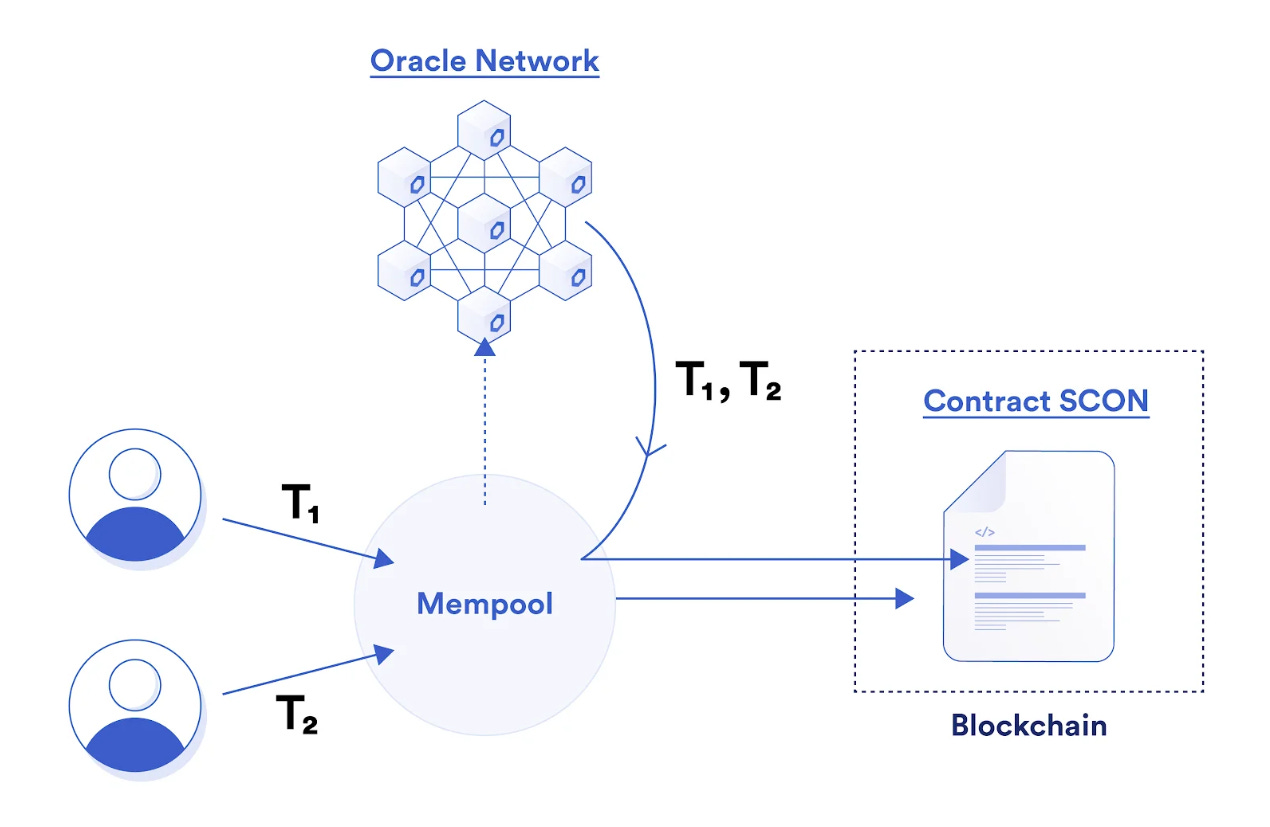

Searchers identify the available MEV opportunities by ordering the execution of user transactions within a block. Builders then make available full blocks to relayers, which serve as the connection point to a blockchain’s block producers.

The diagram above describes the roles these third-party actors play in the MEV ecosystem. Let’s discuss further what their individual roles are.

Searchers

Searchers are third-party actors in the MEV ecosystem that actively look for opportunities to extract MEV by ordering the execution of user transactions within a block. They actively monitor the mempool and look for ways to extract the most profit from user transactions. The strategies searchers use to gain profits from MEV are somewhat similar to what the traditional finance market uses, such as arbitrage, liquidation techniques, and sandwich attacks.

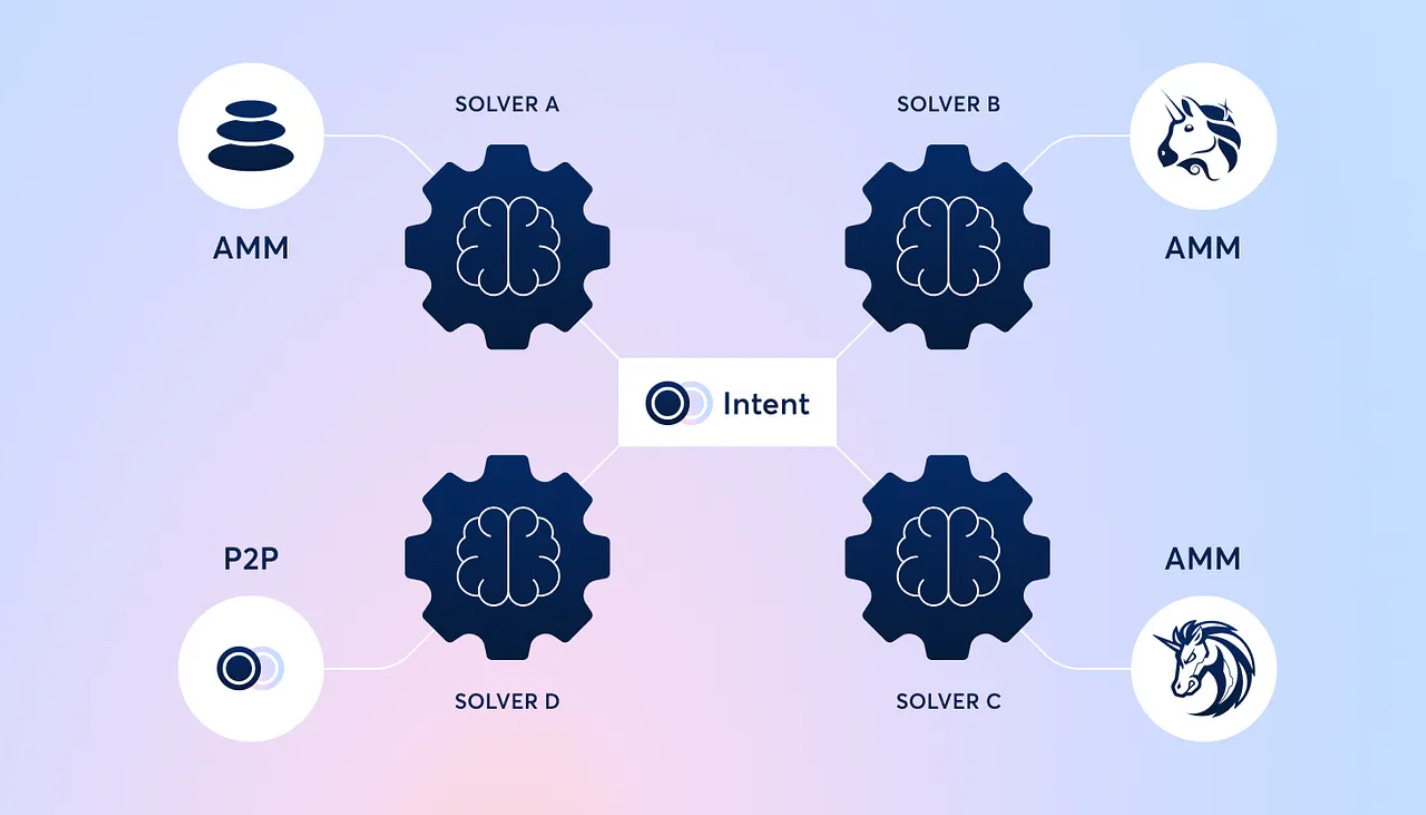

Some protocols have implemented features to counteract the negative effects of searchers in the MEV ecosystem, as they through arbitrage opportunities pocket a large portion of the arbitrage opportunities themselves, thereby not benefiting the end user (traders). To date, MEV has cost traders a loss of $1.5 billion in losses. One of the protocols that has introduced a solution to this is the CoW Protocol – a meta DEX aggregator that relies on third parties’ “solvers”. The protocol uses an intent-based trading system where user intents are grouped into batches. Here, CoW Protocol users place orders by signing an "intent to trade" message that specifies parameters like the assets and amounts they would like to trade. The intent is a signed message that allows the solvers to execute a trade on behalf of the user using their specified assets and amounts.

At its core, searchers and solvers optimize for the same thing: maximizing profits. However, they serve different purposes, so their incentives differ. Searchers basically benefit only validators as they perform MEV attacks on vulnerable transactions – giving users worse prices and therefore giving validators the more chance to maximize profits via higher transaction fee to include transactions in a block while solvers benefit the end users (traders) by giving users a fair price as the solver that can execute the best order wins the right to settle a batch.

On other DEXs such as Uniswap, users execute their own trades on-chain directly and searchers bid for the right to re-order their execution on relays, which we’ll discuss in more detail later in this report. The most profitable and skilled searchers on Ethereum are the ones who are experts at monitoring and analyzing on-chain activity, particularly decentralized finance (DeFi) trades. Searching also requires a strong knowledge of financial markets and trading, as these skills are critical for identifying and exploiting market inefficiencies that create MEV.

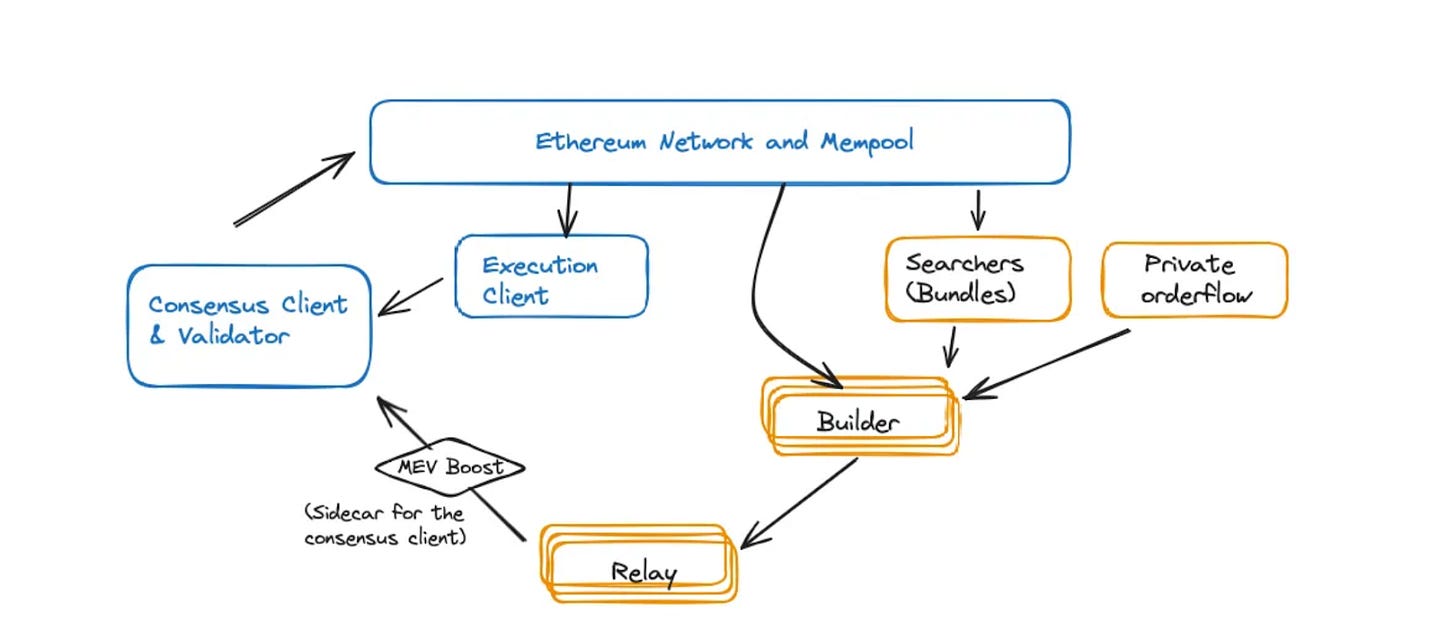

Block Builders

After “The Merge”, a great change ensued, which is the separation of block proposals from block builders, and so came the block builders, who play a crucial role in the MEV ecosystem. Block builders are responsible for bundling transactions from searchers, individual transactions from the mempool, and advanced users who send private transactions to a specialized block builder like “Flashbot Auction”. Builders often simulate block spaces that have not been filled by bundles and can be filled with profitable transactions from the mempool and other sources. They have advanced knowledge of block inclusion strategies for bundles of transactions.

Block Builders simulate bundles of transactions in a block, calculating and evaluating their worth. This is really computationally intensive and, as such, requires specific high-end hardware that enables them to run multiple nodes simultaneously. They are similar to searchers in that they think of unique ways to simulate full blocks based on incoming transaction data. They wait for the last moment before proposing a full block to maximize the amount of potential MEV for block inclusion. Before the Merge, the task of packaging searchers’ transaction bundles into blocks was the responsibility of miners and mining pools.

Before the Merge, miners expended most of their electricity solving a hash function as many times as possible. The first miner to find an acceptable hash would have the right to propose the next block. Miners also expended electricity on ordering and reordering transaction bundles from searchers to maximize the rewards they could earn from a block. Fast forward to September 2024, and now validators, who have replaced miners, expend little to no electricity to propose a block on Ethereum. They are randomly selected by the protocol via RAND0.

Relays

Relays are a key actor in the MEV ecosystem and do only one job – connecting both the builders and validators in a trusted manner. More so, relay helps in the distribution of transaction bundles from searchers to builders and blocks from builders to validators. Relays can be seen as middlemen between block builders and validators to ensure that they do not cheat one another. They create a marketplace for validators to outsource block building and sell block space to the highest bidder.

Technically, relays can engage in malicious behavior within the MEV ecosystem: they are able to see the content of blocks submitted by builders, they can then rebuild the block in any way they desire, sometimes providing blindBlock (only block header, no transaction information) to validators (block proposers) for signing. This can cause slashing to the validators.

Block Proposal with Relays

Block proposal with Relays provides an additional advantage for validators (block proposers) since they gain more rewards, such as:

Block bundle tips from block builders.

Staking rewards for securing the network.

They get MEV payout every 7 days with the Proof of Neutrality relay.

But wait, let’s first understand how block proposals with relays happen.

Block builders send their block bundle to the relay, which then chooses the highest tipping block and ensures the validator gets that tip. They then connect the block bundle with the validator that is chosen via RAND0 to propose the block, and they provide the validator with just a block header as to conceal the block’s content for the validator not to steal and recreate the transactions bundled in the block for themselves in the process.

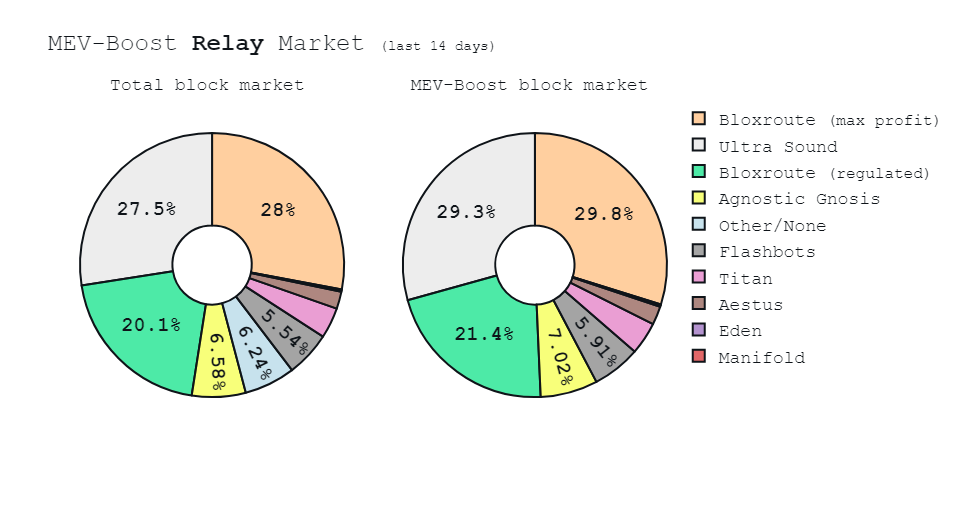

BloXroute MEV service is one of the leading blockchain infrastructure companies that allows traders to submit MEV bundles to their “in-house” builders (they are known to subsidize their own builders). It is economical for most relays to have a well-balanced relay fee. BloXroute is one of the companies that charges for its relay services. They utilize a Blockchain Distribution Network to enable thousands of on-chain transactions per second on blockchain systems. BloXroute is one of the relays that is permissioned and requires builders to be approved before they are able to submit blocks. They reject blocks from builders who try to source transactions from an order flow. Other companies in the MEV relay market that help to connect builders and validators in the most balanced manner include UltraSound, Agnostic Gnosis, Flash bots, Eden, and Titan, among others.

Validators(Block Proposers)

Validators, also known as Block proposers, are responsible for verifying and recording transactions on the network and adding new blocks of transactions to the chain. Validators have the final say in the whole MEV ecosystem since, without them, new blocks can not be added to the chain. The whole concept of MEV came to be as validators can choose transaction blocks that have higher fees, enabling them to maximize profits over transaction blocks that have lower fees. Before the “Merge”, validators were equivalent to miners in the Proof of Work system. To become a validator on the Ethereum network, you either need to have a total minimum of 32 ETH or join a staking pool if the validator does not have up to the minimum of 32 ETH. Also, validators need to run nodes and configure the required software needed to perform the roles of a validator. At their core, validators do not have much freedom to earn rewards aside from gaining staking rewards for securing the network. Validators are meant to be limited and not have much freedom in the ecosystem.

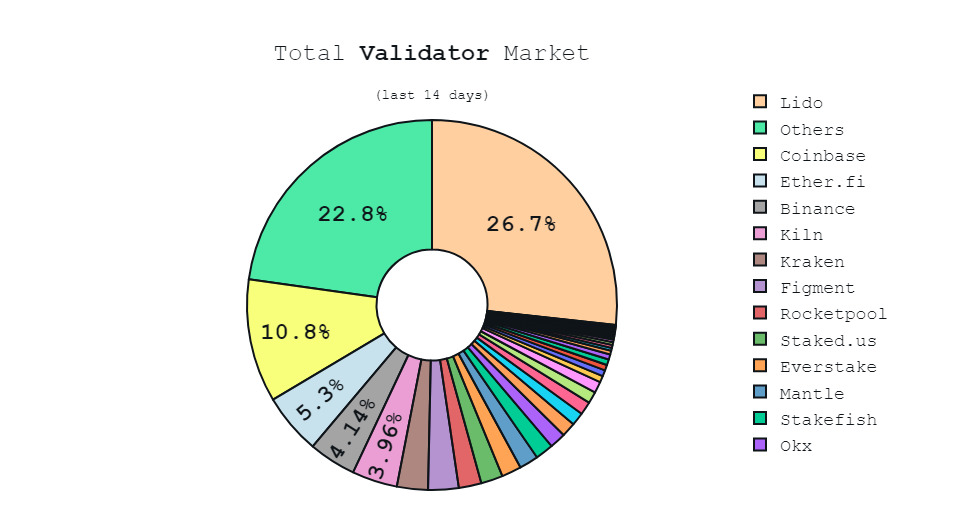

Competitions among validators in order for them to maximize profits would lead to two outcomes: centralization and specialization of validators. This outcome comes with risks that will affect the Ethereum ecosystem negatively, such as the centralization of validators could potentially cause the MEV rewards to be concentrated in a small group of validators, which could lead to them exerting influence on the network through collaboration among each other. Staking pools, on the other hand, are a mechanism that allows validators who do not have the minimum ETH required to become an independent validator to come together in a pool to help increase their chances of being selected as block proposers.

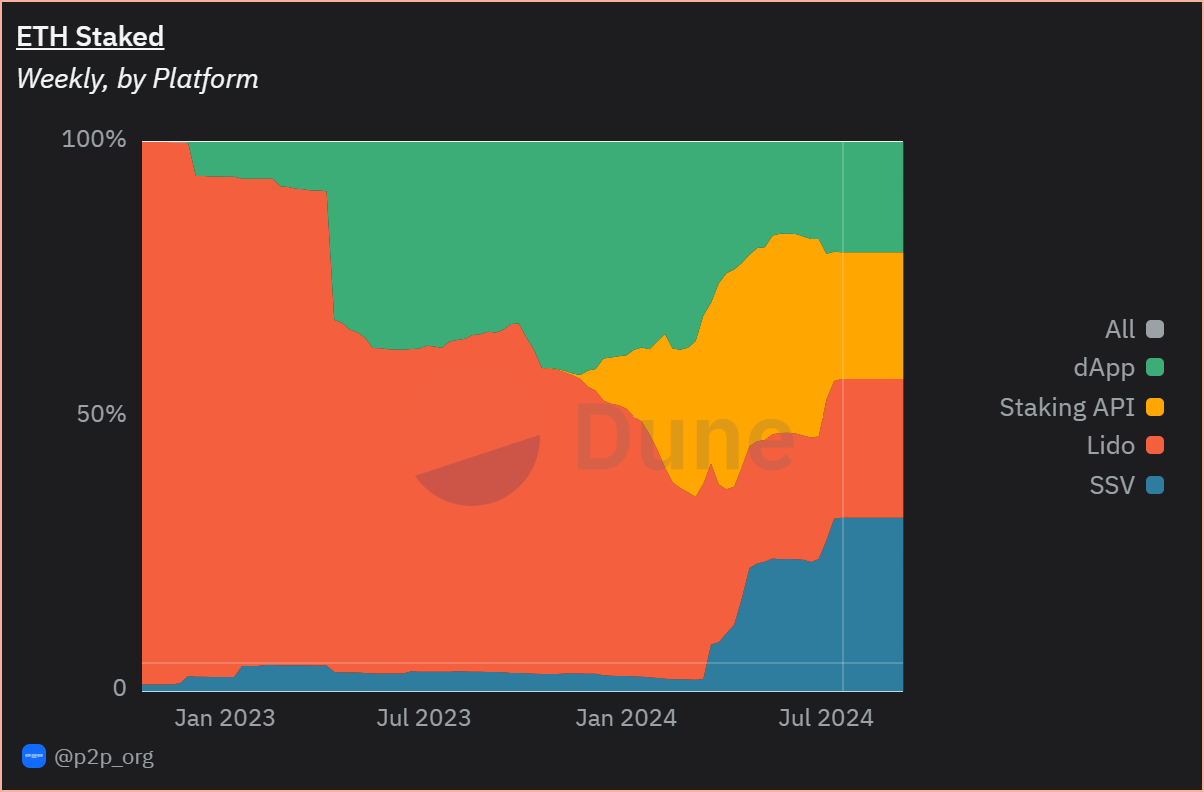

Currently, in the MEV ecosystem, Lido, a decentralized staking protocol service, is one of the leading validators in the MEV validator market. Lido allows users to stake their ETH to the Lido staking pool and receive stETH (staked ETH) tokens in return, then deposit the stETH into another DeFi application such as Aave to earn more yield. The concept of depositing a stETH into another protocol is called rehypothecation. Rehypothecation in the traditional finance market can be seen as simply using collateral assets in another financial system to gain more profit. Other validators in the MEV market today are Coinbase, Ether.fi, Binance, Krake, and much more.

Liquid Staking services incentivize their users by giving them rewards to keep their assets for a longer period of time on their platforms. More so, with this, they can help support the independent validators in cases of node failure. Lido has the highest amount of ETH staked on its platform.

MEV Extraction Strategies in the Ethereum Ecosystem

Thus far, we have only discussed what MEV is, the key actors in the MEV ecosystem, and a few other key points. We have yet to actually talk about the various strategies searchers use to exploit MEV in the ecosystem, not all of which have negative influences in the Ethereum ecosystem. These strategies, as of date, are the only strategies searchers use to exploit MEV, and as the network grows, more strategies are sure to emerge.

Arbitrage

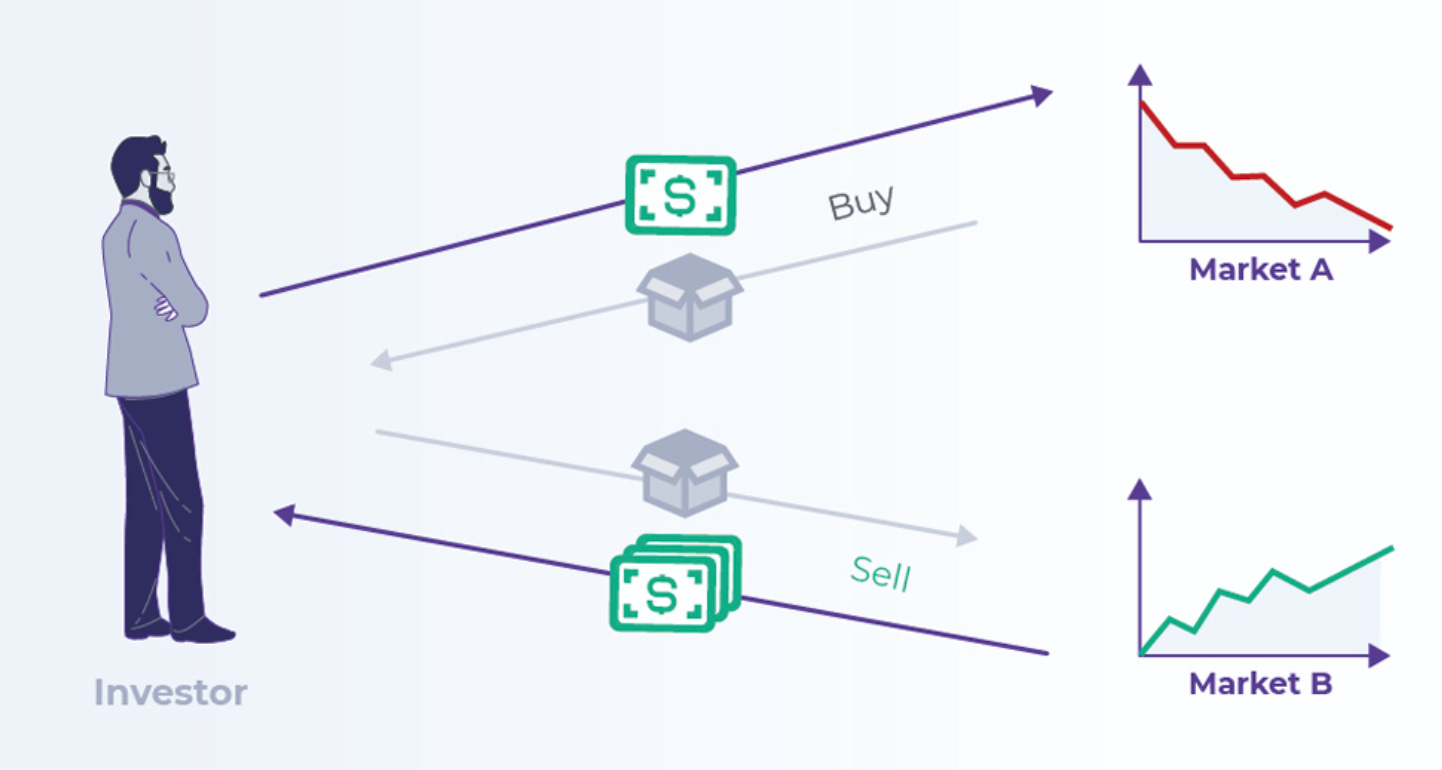

Arbitrage is one of the most popular MEV strategies in the Ethereum ecosystem. Arbitrage capitalizes on the fast price difference, which is second nature in the volatile crypto market. It simply means exploiting the price difference between two assets in the market. It is the most profitable MEV strategy in the market, as depicted by EigenPhi with $2.27M as profit. It simply involves the simultaneous buying and selling of an asset on one exchange, which has a lower price, and then selling it on another exchange at a higher price; the price difference is the profit.

For instance, if the ETH price is $2,340 on Bybit and it is $3,000 on Binance, you can buy ETH on Bybit and sell it on Binance, and the price difference, which is $660, is the profit. Arbitrage is a strategy that leverages the price difference of digital assets across various exchanges. This strategy makes price discovery easier to spot and, as such, it attracts many users and less profits for traders. To better understand Arbitrage, let’s understand how prices in the crypto market work.

The price of cryptocurrencies in the crypto market is simply determined by the demand and supply. It is determined by how much interest there is in the market to buy (demand) as well as how much is available to sell(supply). For instance, if a whale that has a large supply of $RICK(a token on Ethereum) decides to sell off their holdings, the market will be filled with $RICK, which means high supply. If there isn’t an equally high demand, the price of $RICK will drop. In the reverse scenario, if a whale buys a significant amount of $RICK, it will cause a lower supply of $RICK and hence drive the price up, as there is not enough supply to match the demand. Crypto arbitrage traders leverage the volatile price difference to make a profit, and they need to do so as quickly as possible to earn the profits.

In arbitrage trading, searchers are the first to discover valuable information such as the price differences of an asset on exchanges. The searchers then submit their transactions with higher gas fees to validators, which then are tasked with adding their blocks to the network, hence they end up making their profits.

Crypto arbitrage can be classified into various types :

Spatial Arbitrage: This simply takes advantage of the geographical price difference that exists for a cryptocurrency. Certain regions may have higher demands, hence higher prices than other regions. It is a variant of cross-exchange arbitrage.

Cross-exchange Arbitrage: This simply is the standard arbitrage, which is exploiting the price of an asset across two exchanges.

Triangular Arbitrage: This form of arbitrage is within a single exchange, which involves three cryptocurrencies. Here, arbitrage traders execute a sequence of trades among three cryptocurrencies by exploiting their price difference; the traders usually end up with a profit higher than their capital they started the trade with. For instance, the trader starts with USDT, buys ETH, uses ETH to $RICK, and then sells $RICK for more USDT.

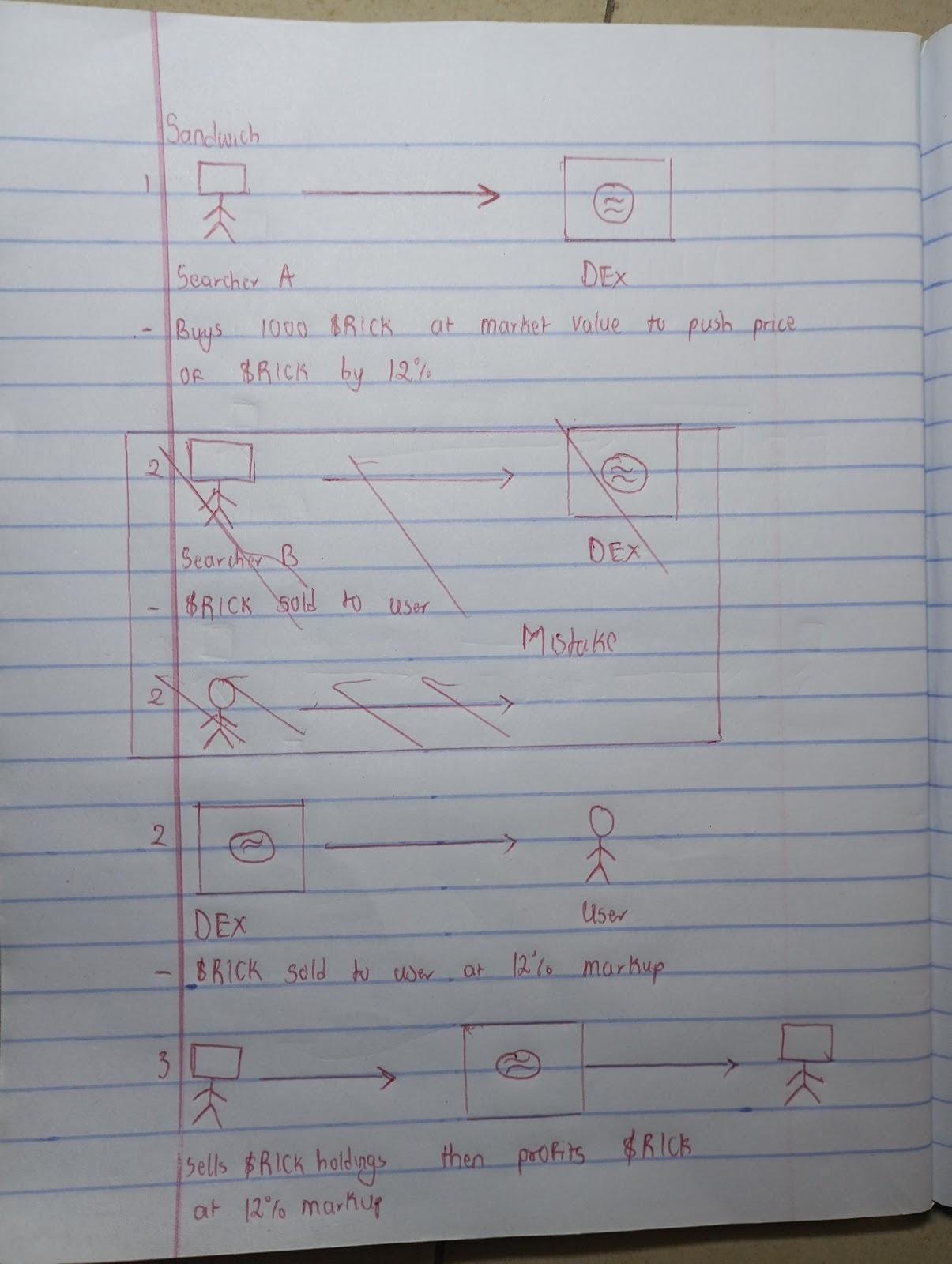

Sandwich

Sandwich is a MEV extraction strategy that involves placing two orders – one just before (frontrunning) and one after (backrunning) a large transaction. This strategy is called a “sandwich” because your trades sandwich larger transactions.

A sandwich attack involves two concepts (front-running and back-running), which we discussed earlier. However, for more clarity, we will revisit these concepts in the context of searchers as key actors in the MEV ecosystem. First, a searcher spots a large trade that is going to happen and then frontruns(placing a transaction ahead of a known future transaction) the trade by placing a buy order with the prediction that the large trade will drive the price up. Once the large trade is executed and the prices increase, the searcher then sells the assets at a higher price, taking the profits from the price difference. This is basically what high-frequency trading in the traditional market is all about.

In the reverse scenario, backrunning is placing a transaction immediately after a target transaction. But why? It all comes down to bonding curves. Bonding curves simply mean the relationship between the token supply and its price.. In bonding curves, by buying large amounts of tokens, you technically “buy up” the curve, thereby increasing the price of the existing tokens in the decentralized exchange. Also, by selling large amounts of the tokens, you technically “sell down” the curve, which lowers the price by reducing supply. For instance, a decentralized exchange which has two cryptocurrencies - $MORTY and $RICK, Rick then buys $RICK using $MORTY, thereby reducing the supply of $RICK, which makes it more valuable and the $MORTY less valuable. In this case, the bonding curve is moved to $RICK. This price difference is often referred to as slippage

When such a transaction is being “backrunned”, the price imbalance can then be used to do arbitrage with other decentralized exchanges. Backrunning on the surface level seems like it is not harmful to the network, as it even provides value to the network by keeping prices among exchanges stable. Backrunning becomes harmful to the network because it can be used which create an incentive to users to spam the network with useless transactions to make a profit, due to the fact that they have to only spend a little bit less gas fee than the target transaction. Sandwich strategy creates a temporary artificial trade volume on decentralized exchanges with the aim of tricking users into purchasing assets at higher prices.

Sandwich MEV extraction strategy has further evolved into Just in Time Liquidity Provision Attack, which is a sandwich MEV extraction strategy that is only feasible in the Uniswap V3 due to its concentrated liquidity, Automated Maker Market (AMM) model.

(my old art hehe. don’t mind it)

Just-in-Time Liquidity Provision Attack

This form of sandwich attack is often referred to as an LP sandwich, which stands for “Liquidity Provision sandwich.” It typically follows a pattern in the Uniswap V3 pool, which is: provision of liquidity, swap, and then removal of liquidity, which is all done in a single block. Searchers first discover a large swap that is about to happen on an AMM pool. The searcher then makes a large liquidity deposit transaction to the pool before the swap and then followed by a sudden removal of the liquidity inserted in the pool right after the swap.

The searcher's earnings come from two major sources :

The searcher earns the trading fee that would have been taken by passive Liquidity pools, and also the searcher saves by not paying the trading fees that the exchange would take for swapping between two assets. But wait, two assets? We will discuss that in the next point on how searchers earn.

In a Uniswap V3 pool, There are other LPs in the pool which prompts the searcher to add liquidity to the pool in the first place, when the searcher withdraws his liquidity, the revenue is split among the participants in the LP according to the amount each individual provided to the pool, ie The more liquidity one deposits, the higher the share of revenue. The revenue being taken by the searcher is a rebalanced asset of what makes up the pool.

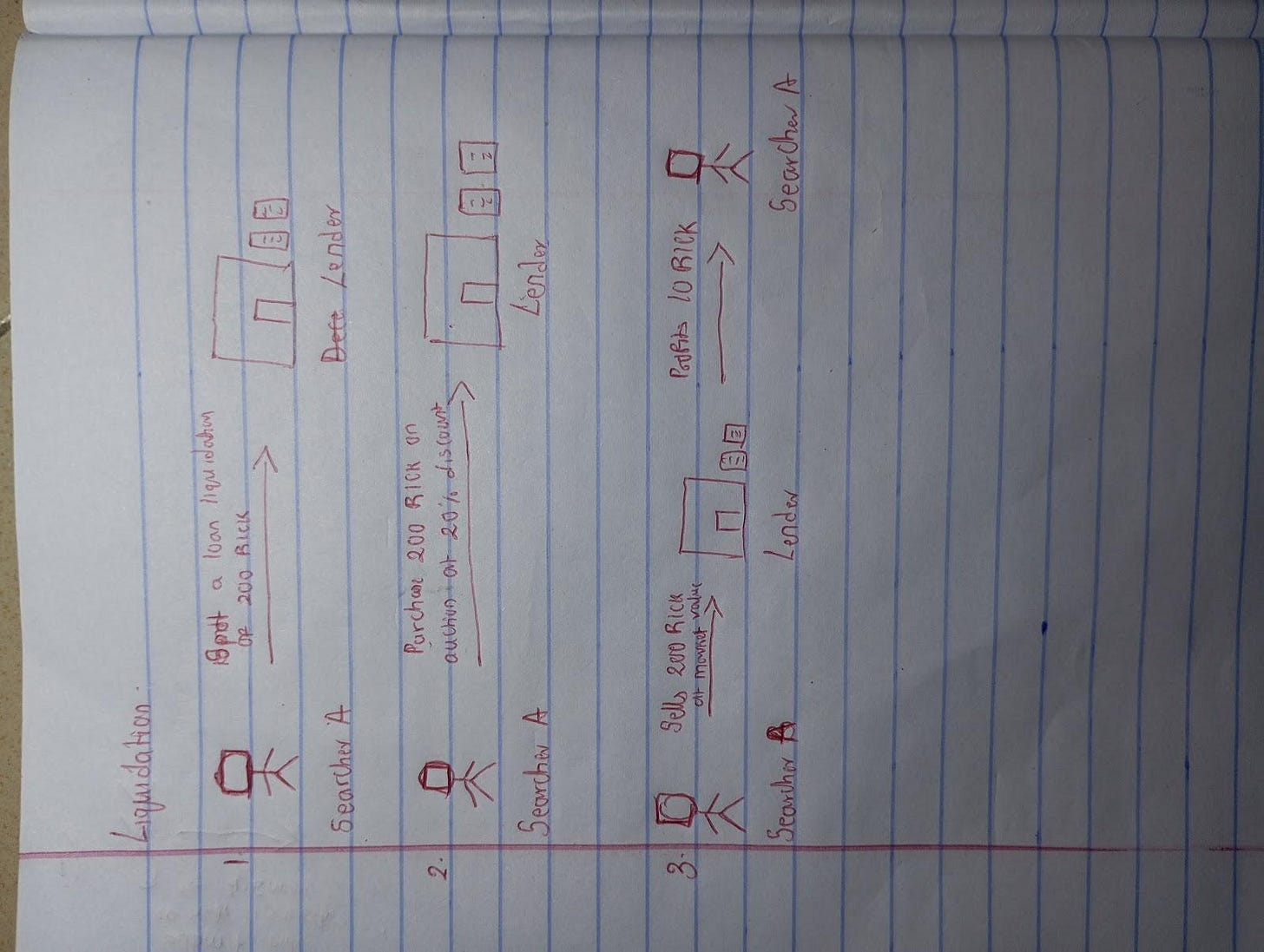

Liquidation

As a MEV extraction strategy, Liquidation is a process that occurs when a borrower(a borrower provides collateral in place of an asset, collateral value does not properly cover their loan (debt) value.

In a decentralized lending exchange, price fluctuation happens and in the event of negative price fluctuation of the loan (debt) collateral (move below the liquidation threshold- liquidation threshold is the percentage at which the collateral value is counted towards the borrowing capacity.), the position can be liquidated (sold at a discounted price) to ensure the balance of the system. For instance, Morty borrows $200k worth of $RICK from Rick, providing collateral of 180k worth of $MORTY. In this scenario, when the price fluctuates, which affects the value of 1 $MORTY and in turn makes the value of $MORTY drop below the minimum, the lending protocol will automatically sell the $MORTY at a discounted price.

Liquidation is simply seen as buying under-collateralized positions to acquire discounted collateral. Searchers monitor lending exchanges for large collateral loans with positions close to liquidation thresholds and quickly buy for a discounted price and sell at a higher price. Liquidation has a positive advantage to the market as the simultaneous buying of discounted prices helps to keep liquidity flowing in the market and ensures that the price is stable among assets.

(old art. yeah, rough)

Risks with MEV Today

MEV was originally meant to enhance the efficiency of validators and users of the Ethereum network, but it comes with two side effects: censorship of transactions by relay and centralization of block builders.

Censorship of Transactions by Relay

The majority of relays in the MEV ecosystem are third-party organizations that are tasked with ensuring the fair distribution of blocks from builders to validators. These organizations are seen as business entities that are not incentivized by the reward of running a relay; rather, they focus on brand awareness to actually build an open-source, performant, and free relay service, which is a public good. An example of such an organization that has built MEV-related infrastructure, including relay, is Flashbot Relay.

A large portion of the relay service follows the US jurisdiction, which also means that transactions not approved by the government will be censored. Since the Merge, more relay infrastructure services have emerged to help combat the censoring of transactions by the Flashbot relay due to the fact that large numbers of blocks are built through this relay, which enforces censoring behavior on transactions, too. Flashbot relay, ever since its establishment, has kept a strong foothold in the MEV market as the “go-to relay” due to its features, such as validators do not need to pay in order to get access to a relay. This has made Flashbot's relay outstanding; the longer it remains standing, it will be the relay that all validators trust. Furthermore, once the full vision of Proposer Builder Separation(PBS for short is targeted at separating the role of validators into block building and block proposing) is achieved, there will be no need for relay, as the function of relay will be enshrined in the core Ethereum protocol. The vision of PBS inspired MEV-Boost.

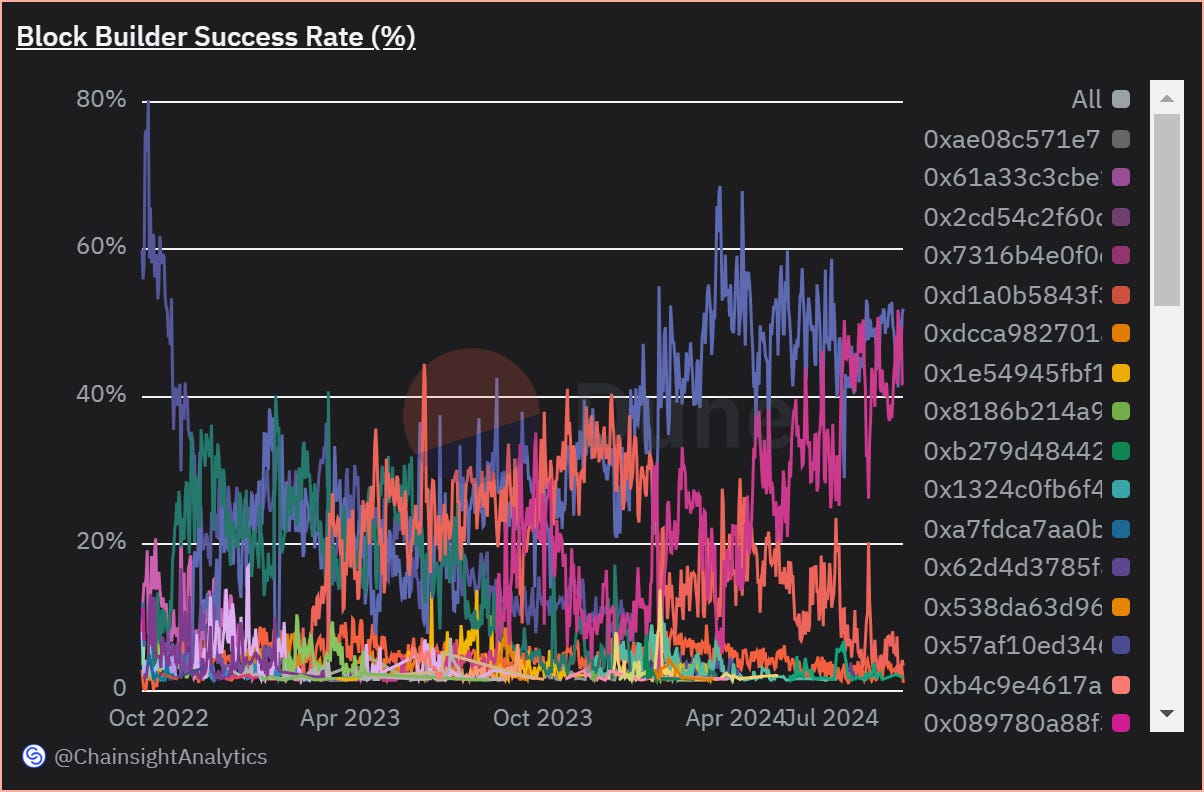

Block Builder Centralization

Block builder centralization can be seen as one of the risks with MEV today. Block builders in Ethereum are tasked with bundling transactions before sending them over to validators who are in charge of adding the blocks to the network. The act of block building is resource-intensive, as block builders have a short amount of time to bundle transactions, which is exactly 12 seconds given to block builders to simulate the maximum profitable block.

The centralization of block builders comes from the fact that if the task of block building is outsourced to a market, that market has the potential of being centralized. But why? Why don’t validators have the ability to propose block, this is not ideal as it will bring an unbalanced system in the market as individual validators who do not have much resources to handle the tasks for block building will be highly disadvantaged when it comes building blocks but large staking pools with multiple resources will find more easier to build blocks which in turn makes the large staking pools to take more of the profits. The idea of outsourcing the building blocks to third parties still has its loopholes; the solution for this will be discussed briefly, and we will shed more light on this in a later series.

One of the solutions proposed by Flashbots to block builder centralization is the introduction of some tweaks to MEV-Boost, an early implementation of PBS on Ethereum. This enables validators to set a minimum bid on blocks they receive from a relay. With such a tweak, a validator can easily build a block from the mempool if the block built by the third-party builder does not exceed a certain threshold. Other solutions tailored against MEV will be discussed more in the next section of this report.

Solutions Tailored Against MEV

There is yet to be a profound solution to MEV. The various solutions needed to solve this complex problem (or at least keep it at bay) require deep-rooted knowledge of blockchain technology, such as consensus protocols, economic mechanisms, and communication paths. The solutions for MEV can be categorized into three areas: P2P layer solutions, consensus layer solutions, and application layer solutions.

The consensus layer solution has come to be the most promising area over the years, as it aims to reduce the consensus instability due to validators’ misaligned interests. MEV, at its core, is an information advantage. You cannot prevent it from being exploited, but you can address it in different ways (potentially, we could combine them one day if we find the right balance). There are various proposals to the MEV issue proposed to the core Ethereum client, such as the encrypted mempool via a time-lock puzzle. In this method, users generate a symmetric key and encrypt their transactions, then provide the validator with the parameters needed to generate a decryption key.

In this proposed solution, users are able to set a desired time delay through a parameter “T”. The validator is then able to decrypt the transactions using the parameters provided by the user. This solution is only feasible if certain conditions need to be met before the data can be accessed such conditions could be time bound. This implementation is actually good, but as such, in the Ethereum ecosystem, this could take a long period of time before it can make its way to production. In this report, we will focus on the following: Chainlink Fair Sequencing Service, Enshrined PBS, and Protocol-Enforced Proposer Commitments (PEPC). Other solutions would be discussed in a later series.

Chainlink Fair Sequencing Service

Fair sequencing service aims to address the issue of ordering problems that are present in the DeFi market. There have been various solutions to issues that arise, such as frontrunning, arbitrage attacks, and so on. However, one area that was overlooked is the unfair ordering of transactions in batches. Fair sequencing targets the issue of censoring of transactions and MEV attacks by ensuring a transparent and unbiased way of ordering transactions in batches. Chainlink is credited for introducing the concept of Fair Sequencing Service.

In today's DeFi market, many of the applications reveal information that can be exploited by users for their own benefits (profit in most cases), which brings an unfair advantage to those who have access to the information. Chainlink FSS hence paves the way toward a fair DeFi ecosystem. In FSS, oracle nodes monitor the mempool and permit off-chain submission of transactions through a specialized channel. The nodes then order the transactions for a relying contract according to a policy defined by the contract. Finally, after ordering the transactions, the nodes then post the transactions to the mainchain. Chainlink FSS provides the following benefits if implemented :

Order-Fairness: Chainlink FSS ensures transactions input to a particular contract are ordered in a way that does not give unfair advantage to well-resourced users.

Reduction of Information leaks: Chainlink FSS ensures that network participants cannot view upcoming transactions

Reduced transaction cost: Due to the fact that there is no need for high-speed submission of transactions to smart contracts, the transaction processing cost is greatly reduced.

However, we are yet to find out how transactions reach FSS. Let’s look at that next.

Chainlink fair sequencing service helps to decentralize the process of sequencing transactions by leaving it up to a decentralized network of committees to decide on the order of the sequence. The committee is formed from Chainlink’s existing oracle network committee members; they already have the trust gained from users, and that makes them a good choice. How does it work? In the first phase of the fair sequencing service, called Secure Causal Ordering, users will send their transactions directly to the committee members in an encrypted form. Encrypted on a public key belonging to a committee, and a corresponding private key that is shared in a threshold way among the committee members. The committee then decides in aggregate how to sequence these transactions off-chain, validates them on-chain, and then decrypts them. The whole idea is that no node will see the gas price or transaction price before the transaction is sequenced, and this prevents a vast variety of MEV arbitrage opportunities from happening, because they don’t know the gas price. However, this method does leak some crucial information, such as the metadata of the transaction, which could lead you to identify the account of the user. In addition, this method also does not stop searchers from doing blind front-running. This first phase heavily relies on the committee members deciding the order sequence of transactions.

Chainlink is currently working on phase two, which aims to remove the reliance on committee members in order to decide the order sequence. This sequence would be called Aequitas ordering, and it supposedly uses the consensus protocol in a way that transactions are sequenced according to the time they are received by the committee. This service works in conjunction to secure causal ordering; they both complement each other and aim to boost sequencing.

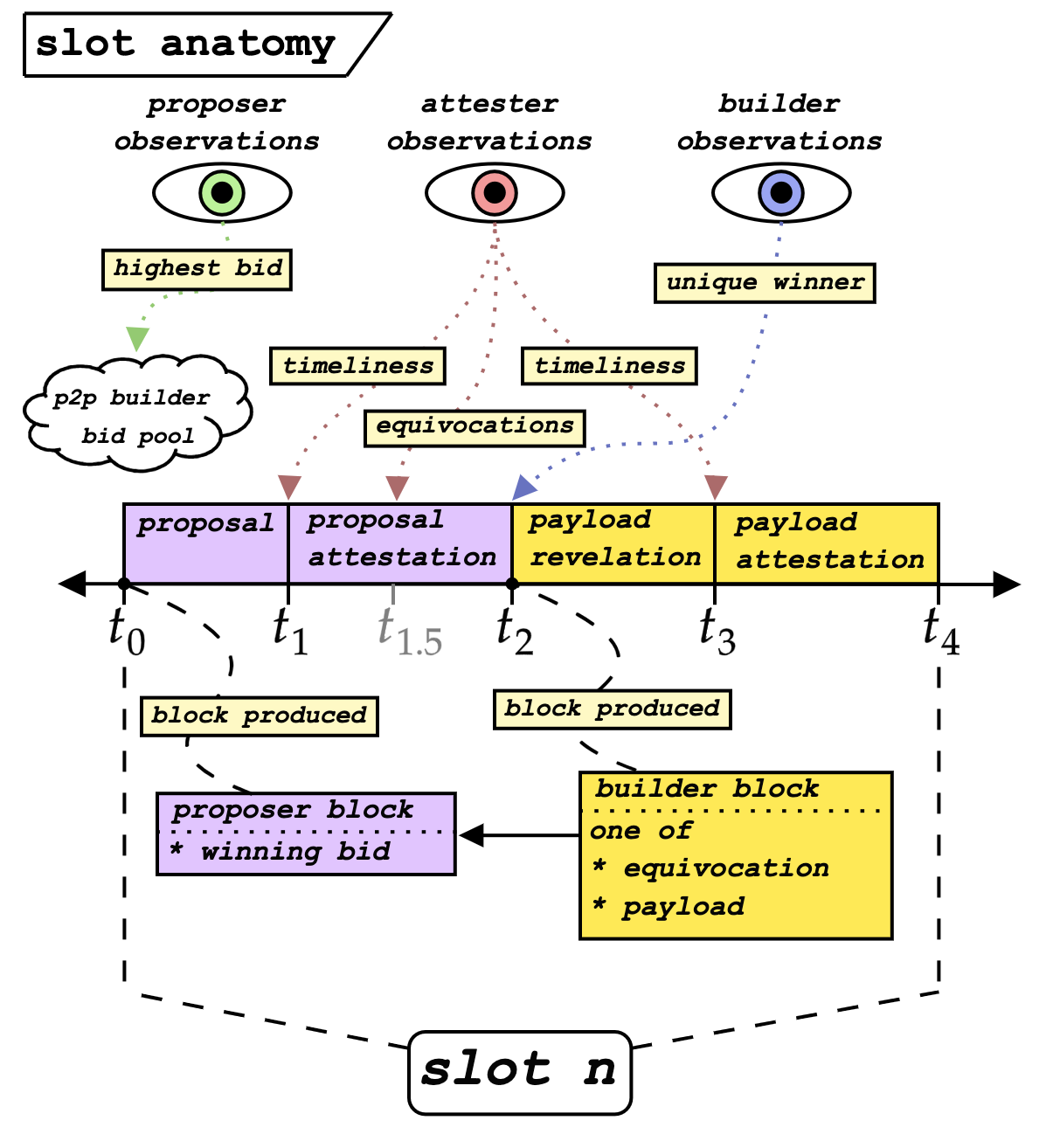

Enshrined Proposer Builder Separation

Enshrined PBS is among the solutions which is tailored against MEV. To better understand how it is meant to combat MEV, let’s understand what Proposer Builder Separation(PBS) is.

Proposer Builder Separation(PBS) enables validators to outsource their block building duties to a set of specialized builders who are well-equipped to extract MEV(hence separating the roles of proposer and builder). Proposers sell their block-production rights to builders who pay for the privilege of choosing the transaction ordering in a block. Proposers earn MEV rewards in addition to their protocol issuance, and block builders compete to assemble valuable blocks while saving a portion of the MEV for themselves as profit.

Enshrined PBS (ePBS) advocates for implementing PBS into the consensus layer of the Ethereum protocol. Because there was no in-protocol solution at the time of the merge, Flashbots built mev-boost, which became a massively adopted out-of-protocol solution for PBS that accounts for most of the Ethereum blocks produced. Enshrined PBS is sometimes called in-protocol PBS. Enshrined PBS is useful so far it has been adopted by builders and validators.

The original proposal of enshrining PBS came from Vitalik Buterin, and he offered two different ideas for implementations. A proposed implementation by “Mike & Justin,” which is a modification to Vitalik’s two-slot design. It is called the Two-Block-HeadLock (TBHL) because it uses a single slot to produce two blocks. The first is a proposer block that contains a commitment to a specific execution payload, and the second is a builder block that contains the actual transaction contents (here, the overall pair of blocks is a “single” slot because only one execution payload is produced). Note that with a second round of attestations, the slot time will likely need to increase. TBHL also incorporates some of the features of headlock to protect builders from proposer equivocations. TBHL shares many components with the current mechanism (HLMD-GHOST). This is the sketch for this proposed enshrined PBS design:

Other Solutions

Aside from the solutions discussed above for mitigating the effects of MEV, there are still others in the discussion pipeline that are not ready for full implementation. They are active areas of research for core researchers and engineers in the Ethereum ecosystem. Such solutions include censorship resistance lists, Single Unifying Action for Value Expression(SUAVE), and Protocol Enforced Proposer Commitments(PEPC).

Censorship resistance lists

Censorship resistance is a fundamental property that underpins the decentralized nature of blockchain networks and ensures the integrity and accessibility of transactions within the system. This proposal provides a list of transactions that block builders must include in their block during the block construction phase. To better understand censorship resistance lists, let’s understand what inclusion lists are.

Inclusion lists are a mechanism aimed at improving the censorship resistance of a chain. It is designed to be non-evasive, such that the implementation of them does not affect the honest block proposer. Censorship resistance lists ensure block builders are not able to censor any transactions; hence, this proposal aims to benefit honest block proposers. Honest block proposers are proposers who include all transactions that pay the prevailing base fee up to the block gas limit, including censorable transactions. As such, honest proposers who use MEV-Boost do not connect to block builders who censor transactions that degrade the quality of a block, thereby removing the power of block builders to censor transactions. Hence, block proposers enforce an inclusion list mechanism of a list of transactions that block builders must include in their blocks. Also, honest proposers always build lists honestly, i.e., they always include all known censorable transactions in their lists. Inclusion lists aim to allow proposers to retain some authority by providing a mechanism by which transactions can be forcibly included.

This proposed solution is, however, not being implemented as it is seen as a short-term solution of removing the ability of block builders to censor transactions and hence not focusing on the main root of the cause, which is finding a solution to decentralize the block builders. This proposal was stated out in EIP-7547 as it provides a mechanism for proposers to retain some control over transaction inclusions, offering them authority in the block production process.

Protocol Enforced Proposer Commitments (PEPC)

PEPC, often pronounced “pepsi,” is quite complex and easily misunderstood. PEPC is still in its research phase, and as such, a definitive mental model has not been set. It’s viewed by many as a generalization of enshrined PBS. Enshrined PBS envisions enforcing a single type of exchange between builders and proposers. For instance, a full block containing a payment to the proposer, in exchange for a signature from the proposer to make the block valid. Meanwhile, PEPC asks: what if proposers were able to enter into any programmable contract with builders?

PEPC allows validators to enforce more complex rules around how a block is made, i.e., implementation of gas limit, reducing the use of block space, and so on. PEPC is often associated with the EigenLayer protocol. EigenLayer serves as the perfect testing ground for the full implementation and realization of PEPC. EigenLayer is a protocol built on Ethereum that introduces restaking. Restaking allows staked assets to be restaked to secure multiple blockchain protocols. For instance, users use their staked ETH in protocols and restake it to support Actively Validated Services (AVS), which could be oracles or rollups that require security but cannot establish a validator set. When validators enter commitments into Eigenlayer, Eigenlayer tracks a “virtual balance” for the validator, initially equal to the total stake that the validator has deposited in Ethereum Proof-of-Stake. When the validator fails to perform services adequately on Eigenlayer, their virtual balance is decreased (”slashed”), but the Ethereum PoS system still believes that the full amount deposited is currently at stake. EigenLayer, as a restaking protocol, has three use cases:

Economic use case: The users of AVS are aware of the staked amount needed to join the protocol and, as such, are affected if commitments are reversed.

Decentralization use case: The users of the AVS are aware that many independent parties are engaged in the provision of the service.

Block production use case: Validators acting as block producers can make credible commitments to the contents of their blocks.

Clearly, PEPC is suited for the third use case, moving the failure mode of proposer commitments from an optimistic setting (the proposer can reverse their commitments, but will be financially penalized for it) to a pessimistic setting (the protocol will not let a proposer reverse their commitment, invalidating the block if it does not satisfy the commitments). PEPC is still an active area of research in the eThereum ecosystem and is a few years away from implementation. Further research is still needed on PEPC in areas such as the implementation of PEPC-Boost, on proposers committing to specific ordering, and so on.

The Future of MEV on Ethereum

The future of MEV is still uncertain, as it is in a research phase due to the impact MEV has on Ethereum, as it is easily misinterpreted. However, the MEV ecosystem is ever-growing and evolving, and as such, new ideas are spontaneous. Several organizations are working on new implementations incorporating MEV to reduce the impact it has on the ecosystem; one notable discussion around this is SUAVE.

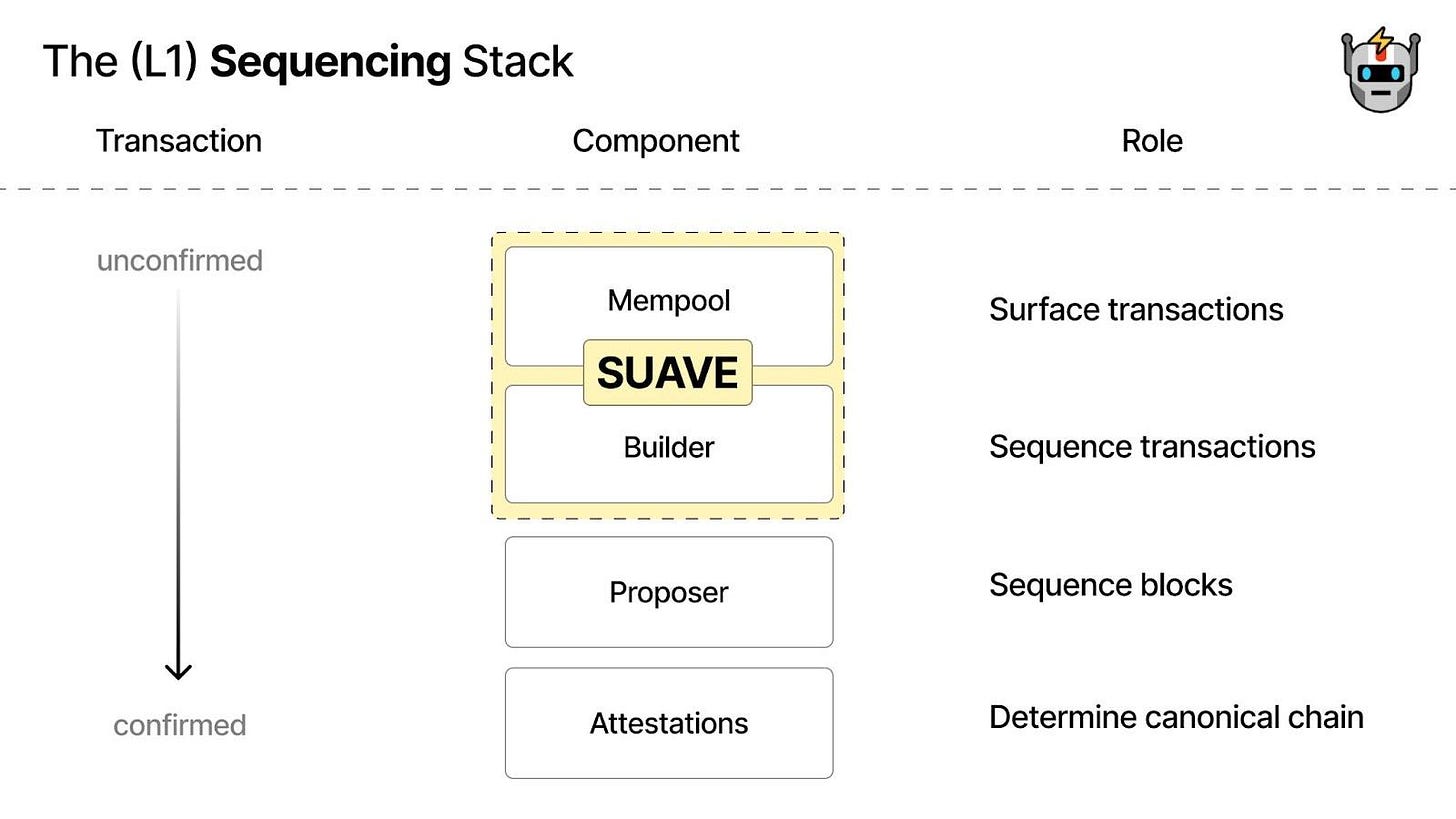

SUAVE is a project being developed by Flashbots, and it aims to bring about a decentralized block builder. This project was designed not only to be meant for Ethereum rather to be for all blockchains. SUAVE takes in input and outputs blocks across domains. The design of SUAVE goes beyond sequencing for a single blockchain rather to be a plug-and-play mempool and decentralized block builder for all blockchains.

SUAVE brings about a lot of market value to the ecosystem through its decentralized block builders, and as such, the market will grow towards many chains sharing a single decentralized sequencing layer, such that the credible neutrality that comes from sharing a sequencing layer gives SUAVE an information advantage, since many parties will share its inputs in a single place. Also, block builders who operate on a single blockchain will be at a disadvantage due to cross-chain MEV.

The goal of the decentralized sequencing layer is to ensure that centralization is avoided at the endgame. SUAVE can be seen as a single environment where different parties collaborate on the expression, execution, and settlement of user preferences in a decentralized manner. A preference is a message that a user signs to express a particular goal and that unlocks a payment if the user’s conditions have been met. They are the native transaction type on SUAVE. It is divided into three components:

Preference Environment: An environment that builds on existing properties of bundles and improves on existing mempools.

Execution Market: Once users submit their preferences to SUAVE, executors(key actors in the SUAVE ecosystem) then compete in an auction to provide users with the best execution possible

Decentralized Block Building: This network takes in all the preferences that have gone through the execution market and hence turns them into blocks. It maximizes MEV for builders and validators, allowing the builders to become decentralized.

These three components will be enabled by a specialized SUAVE Chain. The chain will be EVM-compatible and provide the scaffolding for all these components to interact with each other and decentralize over time.

How does PEPC relate to SUAVE?

PEPC complements SUAVE by offering the possibility to make credible commitments before block construction, i.e, committing to block specifications before the block is completed.

Furthermore, in the future of MEV, MEV still exists in the rollup(Layer 2) ecosystem, but it simply exists differently. In Ethereum, any actor who can reorder transactions can extract MEV, which is the block builder, and in rollup, it is the sequencer. So, MEV is swapped for Rollup Extractable Value (REV). There are some solutions to combat MEV in the rollup ecosystem, and as such a notable ongoing research is on a Decentralized Anti-MEV sequencer based on Order-Fairness Byzantine Fault-Tolerant (BFT) consensus proposed by KD_Conway. This mechanism is designed to counteract MEV and ensure transaction fairness. This system provides the following:

Decentralization: Instead of using a centralized sequencer, this system brings a sequencer network with multiple nodes that are contributing to transaction ordering and batching.

Order-Fairness: The transactions are processed based on the time they were received by the nodes in the sequencer network, ensuring no one participant can manipulate transaction ordering.

Byzantine Fault Tolerance: The consensus protocol ensures the system remains operational even if some of the participants behave maliciously.

A simple workflow for this system is as follows. When a user wants to send a transaction on a layer 2 blockchain, they submit the transaction to the sequencer network. The Order-Fairness BFT consensus is employed to determine the correct order of transactions. This guarantees that, even if a minority of nodes act maliciously, the system can still reach consensus on a fair transaction order. After reaching consensus, the sequencer batches the transactions and submits them to the Rollup smart contract on Ethereum, where they are executed in the agreed-upon order. This proposed solution is still in its research phase, with major discussions yet to take place. Some concerns about this solution include, and potential counteractive propositions to those concerns are:

Does this scheme just shift mechanics to the reordering of timestamps? – According to the definition of order fairness, if 𝛾 fraction of honest nodes receive a transaction tx before tx′, then tx should be ordered no later than tx’.Therefore, the minority of malicious nodes cannot manipulate the transaction order within a block. In this approach, shorter network latency may provide an advantage in terms of MEV.

How does this solution combat randomness and privacy? As if this is not done, it can be easily gamed. As for privacy, it is possible to utilize zero-knowledge proofs to create a privacy layer 2 similar to Zcash. For randomness, a straightforward method involves having the sequencer first batch the transactions into a block and then use a verifiable random function to generate a random number, which can be employed to permute the transaction order.

The concerns and solutions are stated by two researchers, respectively – owizzdom and KD_Conway.

Conclusion

The future of MEV is still uncertain with the emergence of new ideas, which have led to the exponential growth in TVL of DeFi protocols. This has also led to new MEV extraction techniques being formed beyond the ones already known, such as arbitrage, sandwich, and liquidation. More so, it's expected that new extraction strategies to emerge will be a combination of one or two of the already known extraction strategies.

Organizations such as Flashbots, which are focused on pushing the boundary of MEV, will keep at it and develop new features to existing ones, and even go ahead to bring about something new, such as the case of SUAVE. Furthermore, talks on how PEPC is related to SUAVE and how it complements it are still ongoing, as are talks on enshrining PBS to the Ethereum core protocol, which brings up its own set of questions. Also, Flashbots is still working towards improving the relay and builder technology.

MEV is an ever-growing field in the blockchain ecosystem, and as such, needs to be mitigated to some point, unlike the traditional finance market, which has a regulatory body to regulate what happens. The body that governs MEV is simply the Ethereum ecosystem, which requires the ecosystem to reach a consensus on how MEV can be mitigated or controlled to a point. Some of which include encrypting information (here we make sure no information leaks to the public, while this sounds good, it comes at the odds of composability, if there are transactions that need to interact with multiple apps and do multiple things, how do we ensure this if the information is hidden -- this therefore can be a balancing act between privacy and efficiency/performance).

MEV, at its core, is an information advantage. MEV is complicated, but it's also very misunderstood. These aren't unique problems for a blockchain. Information advantages are inherent in almost every system in life that people interact with. When it comes to market design (which is essentially what blockchains do for selling blockspace to transactions), every market has these challenges. The difference is that in the decentralized setting (and with the technology we have available), we have an opportunity to design mechanisms to address these. But the solutions are only as powerful as the wisdom of those who know what the objective should be. When you understand that MEV is simply an information advantage, you realize turning it to zero is not realistic. That doesn't mean there isn't a solution. It simply means you need to understand the nature of the problem in the first place.

References

Understanding Ethereum Transactions

What are Ethereum Transactions

How Flashboys became Flashbots

Why Enshrine Proposer Builder Separation

This is an absolute banger