This paper is dedicated to Prasad for the clarity and for always seeing the crack before they formed. Thanks to Bithiah for feedback.

Vertex in Brief

Vertex is a decentralized exchange (DEX) built on Arbitrum, offering spot trading, perpetual contracts, and money markets. Although it was launched in 2022, Vertex officially went live in the spring of 2023. Its core value proposition was ambitious: to combine three major DeFi services, an AMM, a money market, and a perpetuals exchange, into a single, unified platform. This integration enabled users to access and interact with all services seamlessly through one interface. Vertex also introduced a hybrid liquidity model, merging a central limit order book (CLOB) with an automated market maker (AMM), allowing liquidity from LP positions to flow directly into the order book.

Thanks to its hybrid AMM-order book design and compelling value proposition, Vertex completed multiple funding rounds backed by notable players in the space, including Jane Street Capital, Hudson River Trading, JST Capital, HTX, GSR, Collab+Currency, Big Brain Holdings, Hack VC, and Dexterity Capital.

As we know, it doesn’t scream crypto without a token (stay safe, anon). And while I only partially believe that, I do think incentives matter.

Vertex introduced the VRTX token, designed to govern the Vertex community and fuel growth initiatives. VRTX acts as the keystone unifying spot trading, perpetual contracts, and money markets into one powerful, integrated order book. The tokenomics behind VRTX were refined to support sustainable growth, incentivize broad participation, and reinforce the long-term strength of the Vertex ecosystem.

Fast forward to 2025, and the ambition hadn’t slowed. But looking back, was that momentum enough?

Before its merger with the Ink Foundation on July 8, 2025, Vertex was on an ambitious trajectory. Its 2025 roadmap laid out plans to expand its DEX infrastructure across 25 EVM-compatible chains, aiming to unify liquidity and reduce fragmentation through the Vertex Edge network. Beyond the tech, the team was pushing hard on incentives, offering campaigns like “Trade & Earn” to drive usage, and launching new governance layers to decentralize decision-making. All of this was designed to deliver CEX-level performance in a fully on-chain system.

The announcement of the merger was met with mixed reactions from Vertex’s liquidity providers, investors, traders, and even passive observers. Some argued that the protocol had lost its direction, perhaps even folded under competitive pressure. This report aims to unpack those concerns by addressing a few key questions:

What was Vertex position in the current state of the perpetual landscape?

Was Vertex’s shutdown a result of the Hyperliquid effect?

And finally, who’s the new kid on the block supporting Vertex?

The Perps Landscape, Vertex & The Hyperliquid Effect

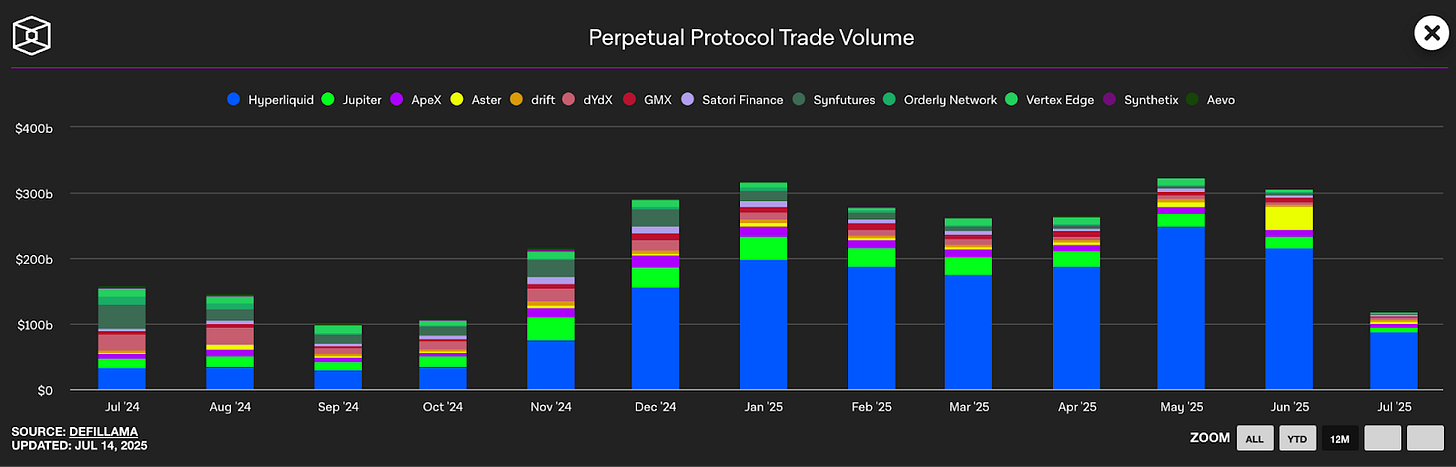

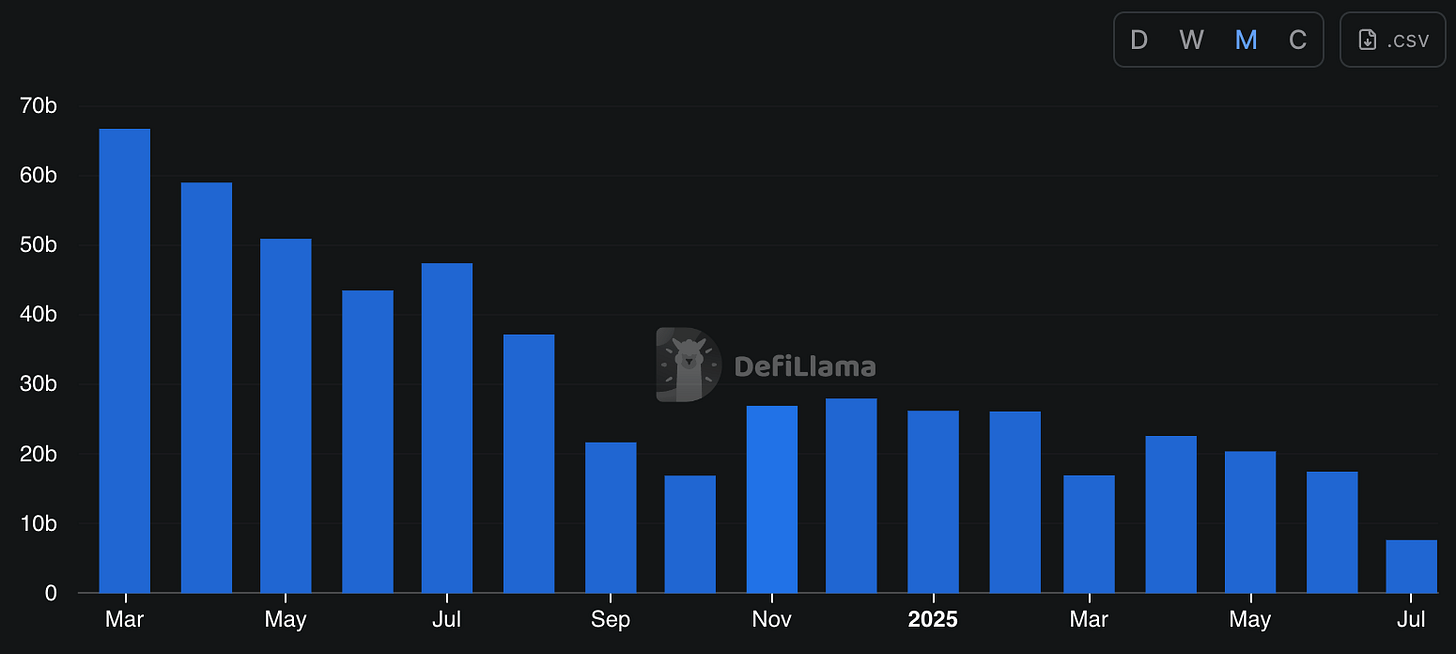

Source: The Block; Perpetual Protocol Trade Volume

The perpetual market has seen explosive growth, with trading volumes tripling since the 2021 cycle. This surge has been largely driven by improved on-chain user experiences, led by products like Hyperliquid, that have made trading faster, cheaper, and more accessible. Since early 2025, monthly volumes have consistently surpassed $300 billion, translating into meaningful fee revenue for both protocols and the blockchains they operate on.

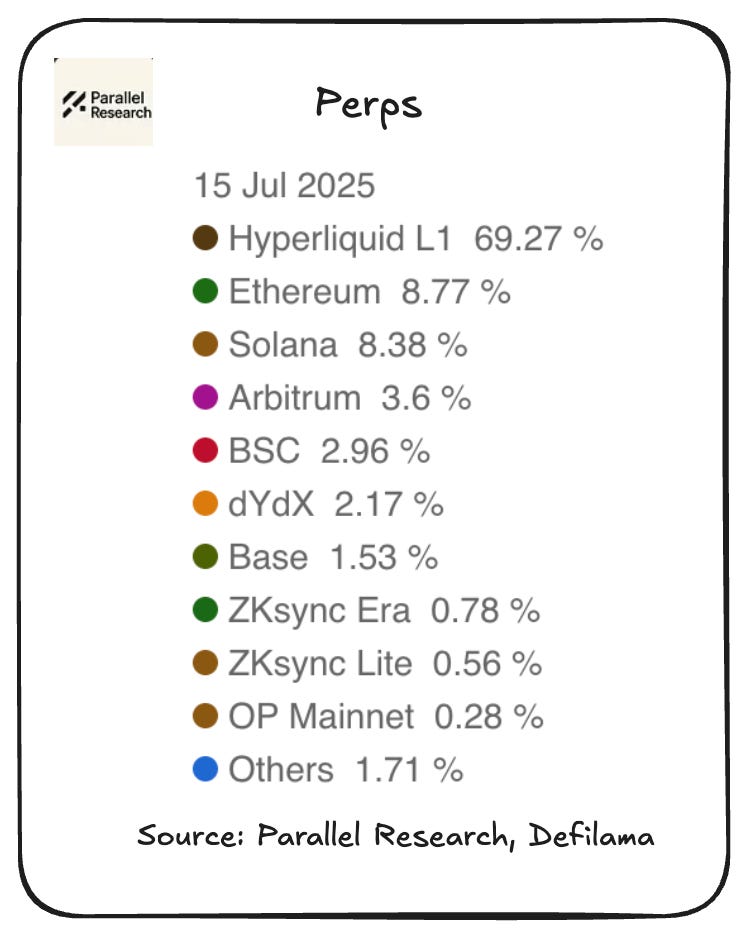

Hyperliquid currently dominates the on-chain perpetuals market, accounting for nearly half of all activity as of June 2025. Ethereum has also gained momentum, almost doubling its share this year, thanks in large part to the rise of edgeX. BSC is seeing similar growth, driven by MYX Finance’s traction. Among Layer 2s, Arbitrum leads in market share, followed by Base and zkSync Era.

Source: DeFilama; Perps Chain

At the protocol level, Hyperliquid’s dominance is even more pronounced, commanding over 50% of the on-chain perpetuals market, far ahead of competitors like Aster, Jupiter, Apex, and edgeX, which trail behind with single-digit market shares.

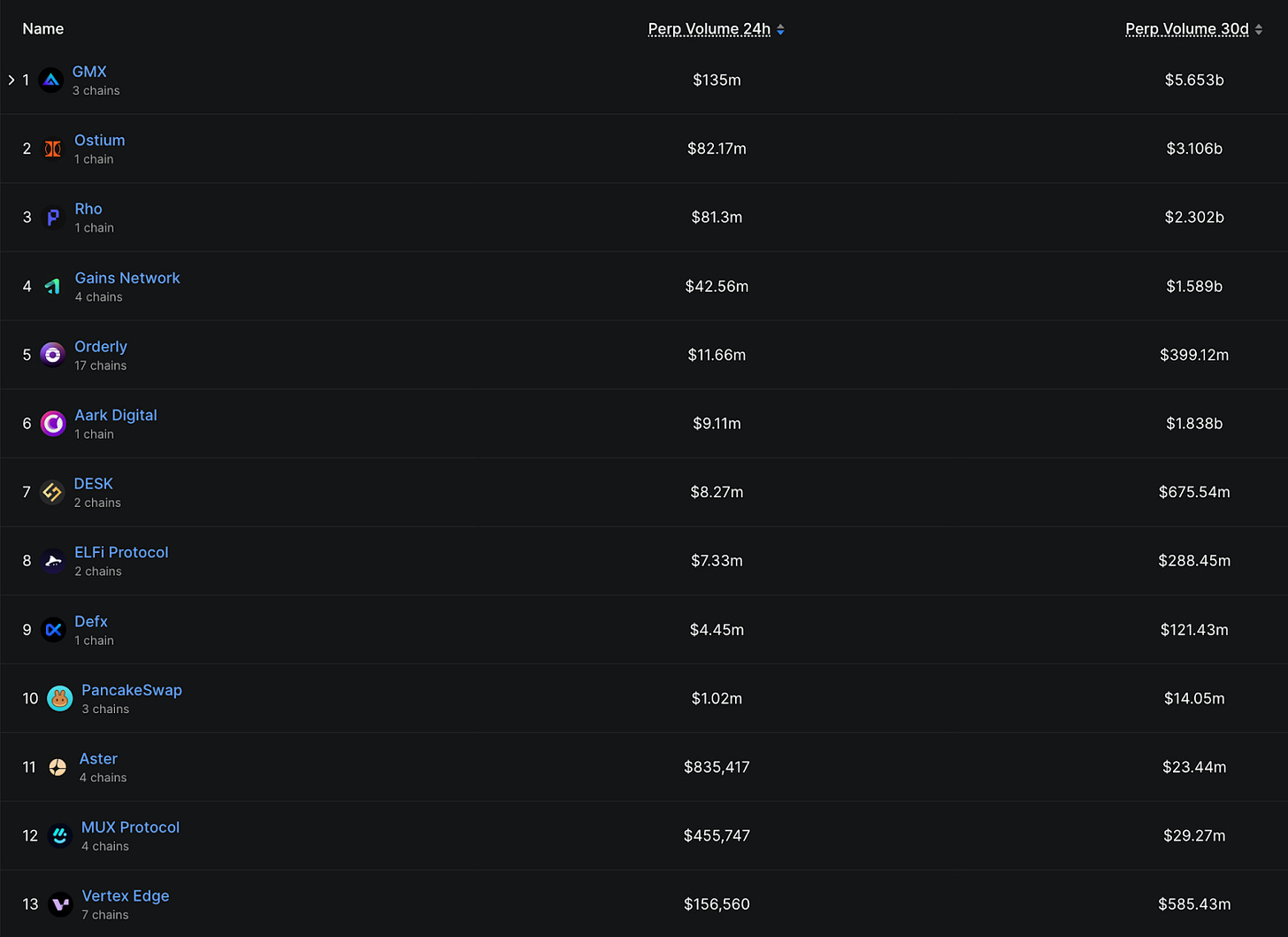

Source: Defilama; Perp Protocols

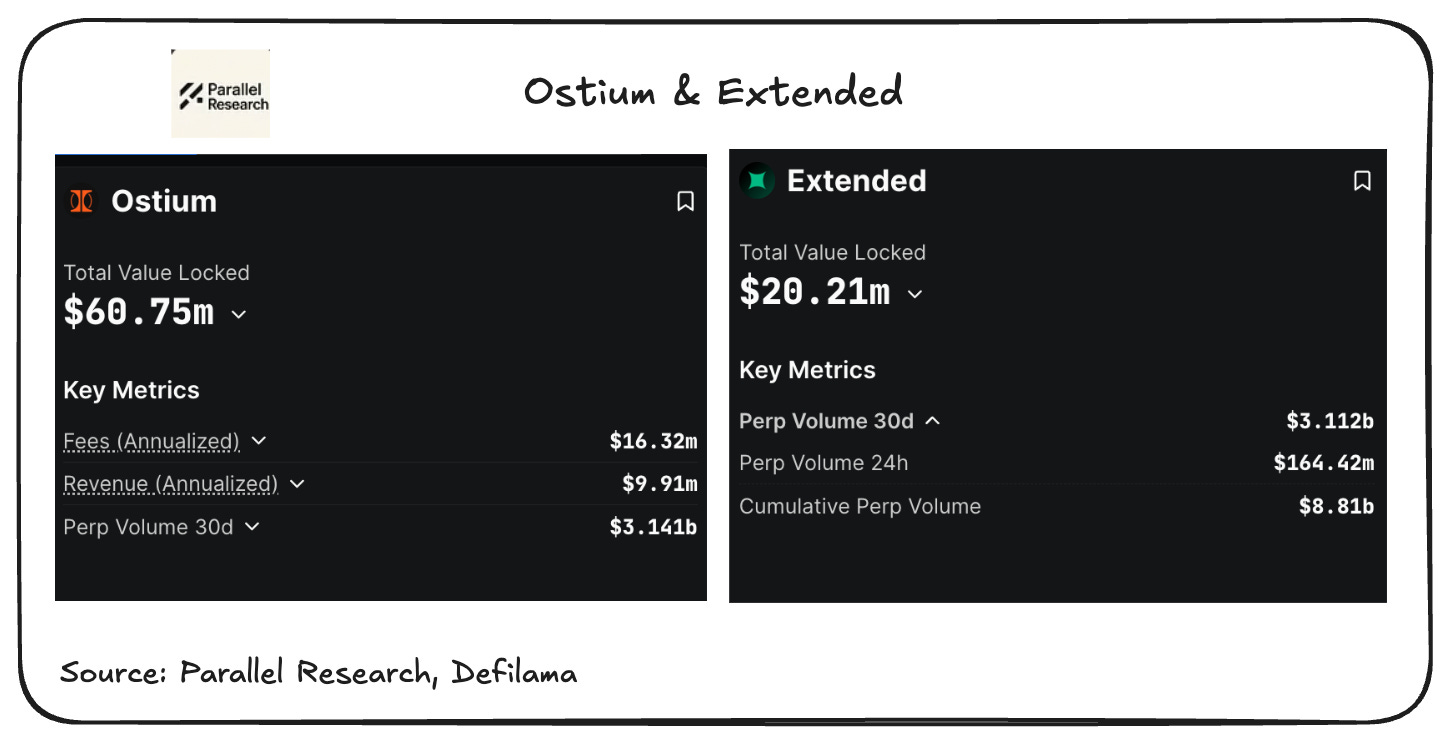

Beyond the top five, a new wave of protocols is gaining traction, fueled by shifting regulatory dynamics and growing demand for on-chain trading. Extended and Ostium, both launched just three months ago, have already secured a meaningful market presence, of having a 30-day volume of over $1 billion. Meanwhile, RabbitX and MYX have seen rapid growth, expanding in a matter of months.

Zooming in on Arbitrum, the chain where Vertex was originally launched, perpetual trading activity has declined by over 50% in the past year, with a volume of $384.49m. While this drop isn’t isolated to Arbitrum, it underscores a broader shift: Hyperliquid has been steadily drawing liquidity away from competing ecosystems. The trend reflects a new reality, one where chains and protocols must actively compete to retain market share and user engagement in an increasingly aggressive and fragmented landscape.

Source: Defilama; Arbitrium (Perpetual Trading Volume)

Regarding protocols on Arbitrium, GMX remained the leading perpetuals platform on Arbitrum in June, but without commanding overwhelming dominance. Trading volume was distributed more evenly across protocols, reflecting a competitive and relatively healthy perps ecosystem. Notably, the recent launch of Ostium has contributed to this activity uptick, introducing a novel perp trading experience that includes non-crypto assets like stocks, broadening the range of trading opportunities on Arbitrum.

Vertex, while once positioned as a core infrastructure player on Arbitrum, struggled to maintain momentum. In its final weeks, the protocol is at 13th and recorded just $156,560 in daily perp volume and around $585 million over 30 days (July), a sharp contrast to its early ambitions.

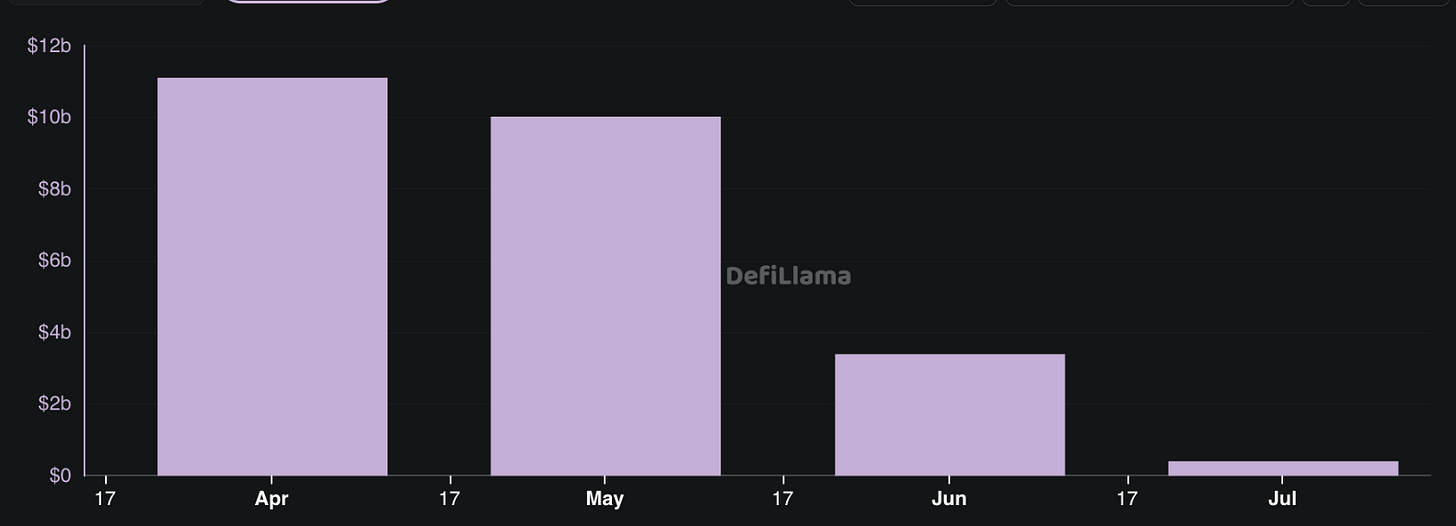

Source: Defilama; Vertex

Vertex's decline in perpetual trading volume is starkly visualized in the chart above. In April 2025, the protocol saw over $10 billion in monthly volume. By May, this had already dropped noticeably, and the downward spiral accelerated through June, ultimately collapsing to a negligible figure by July. This steep fall-off reflects a combination of internal stagnation and external pressures, most notably the growing gravitational pull of Hyperliquid. As liquidity, users, and attention migrated elsewhere, Vertex struggled to maintain relevance, setting the stage for its eventual shutdown and merge.

So, the Merge happened, now what?

Here, I’ll briefly outline the key details of Vertex’s merge into the Ink Foundation. This section is meant to provide a concise summary; the full context and intent are best understood by reading the official announcement.

As part of the agreement, Vertex will sunset all of its current EVM deployments, including its existing DEX infrastructure, and transition toward launching a new version of the protocol that is purpose-built for the Ink network. The move reflects both a strategic pivot and a broader trend: consolidation among protocols in response to intensifying competition, shifting market dynamics, and evolving user expectations.

At the core of this transition is the retirement of the VRTX token, which served as the protocol’s governance and incentive mechanism. VRTX will no longer hold utility going forward; staking, rewards, and buybacks will cease. Instead, 1% of the total INK token supply has been allocated to VRTX holders via a one-time airdrop. Importantly, all treasury-owned and non-vested VRTX tokens are excluded from the drop and will be burned.

On the technical side, Vertex’s core infrastructure, including its synchronous orderbook engine, perpetuals platform, and money market stack, will be integrated into the Ink L2 ecosystem. The goal is to help Ink build out its DeFi layer with CEX-like performance while preserving the values of composability, transparency, and non-custodial access. This merger is not just a rebrand, it’s a refocus. Vertex’s team and tech are now aligned with Ink’s roadmap to power scalable, capital-efficient, and vertically integrated on-chain trading infrastructure.

While full distribution mechanics and incentive program details are still forthcoming, one thing is clear: this marks a defining moment for both Vertex and Ink. For Vertex, it closes a chapter that began with its launch on Arbitrum in 2023 and peaked with over $224 billion in cumulative trading volume. For Ink, it accelerates the mission of building an open, high-performance financial layer on-chain, backed by infrastructure already proven at scale.

Thoughts

Regarding Vertex,

I believe Vertex Protocol’s shutdown and its migration to the Ink Foundation reflect not just external market pressure but also a deeper internal struggle and loss of strategic direction. While the dominance of Hyperliquid certainly accelerated its decline, capturing 70–75% of the perpetual DEX market with over $1.5 trillion in total volume, 0% gas and 0.025% trading fees, lightning-fast execution at 200,000 orders per second, and a wildly successful HYPE airdrop that onboarded over 2 million wallets, I don't think that was the sole reason Vertex folded.

In my view, the real issue was that Vertex lost its edge and drifted from a focused vision. The platform stretched itself thin by expanding across nine EVM chains ( even aiming for 25), juggling spot, perps, and money markets, and trying to do too much at once. The April 2025 desync incident (temporary mismatch in its order book and blockchain state, delaying user withdrawals) didn’t help either; it seriously dented user trust and exposed underlying technical weaknesses.

By the time the shutdown was announced, liquidity had already dried up, and the token (VRTX) had lost 41% of its value. While competition was certainly fierce, I think Vertex’s failure was more a result of overextension, poor narrative control, and an identity crisis than simply being outcompeted. The merger with Ink and the sunset of its native token seem like a desperate but strategic pivot, one that indicates the team knew they couldn't keep up without starting fresh.

Source: CoinGecko; Vertex Token

Heck, even the token completely tanked since the July 8 shutdown announcement. Looking at this chart, it’s clear that confidence vanished almost instantly; the price plummeted from just under $0.012 to barely above $0.0017 in a week. That’s a brutal ~85% drawdown, and it’s not just a flash dip; the downtrend has been steady and unrelenting. Volume also faded, showing that both traders and holders likely gave up or exited. This kind of market reaction shows how much trust had eroded, and reinforces my view that Vertex didn’t just lose to competition, it lost its identity and support base.

Now this begs the question: can the void left by Vertex truly be filled? A pillar of salt can’t mend a shattered cup; the foundation may still stand, but the function is lost. While no replacement will replicate Vertex’s exact model or trajectory, a new protocol could rise to redefine what that space looks like.

Enter Paradex Network, the new kid on the block, leaner, more focused, and arguably learning from Vertex’s missteps. With a tighter product scope, innovative liquidity incentives, and a clearer narrative, it’s positioning itself not to copy what Vertex was, but to become what Vertex could’ve been.

Paradex Network: Stepping Into the Gap

Paradex is a high-performance decentralized exchange (DEX) that blends the speed and liquidity of centralized exchanges (CEXs) with the transparency and self-custody of DeFi. Built on Starknet’s Layer-2 appchain, it offers a seamless trading experience across over 250 markets, including BTC/USDC, ETH/USDC, and SOL/USDC, with a daily volume of $214 million.

Backed by Paradigm. Paradex isn’t just another DEX; it’s part of a wider ecosystem that includes its appchain (Paradex Chain), synthetic dollar (XUSD), and native token ($DIME). With Retail Price Improvement (RPI) orders that let you fill inside top-tier CEX spreads, zero-knowledge encrypted accounts for privacy, and a unified margin system across spot, perpetual futures, and perpetual options, Paradex is setting a new standard.

Whether you’re looking to trade with high leverage or earn passively through yield vaults, Paradex has something for every type of trader. It's designed for speed and scale, but also user control, making it a powerful alternative for those affected by Vertex’s recent exit. From casual traders to institutional desks, Paradex delivers the performance of a CEX without sacrificing the core values of DeFi.

Paradex runs on a hybrid architecture that smartly separates high-performance components off-chain and keeps all critical trust functions on-chain. Its matching and risk engines operate in the cloud, giving traders sub-50ms order execution speeds, comparable to CEXs, while eliminating the congestion and cost issues that plague fully on-chain systems. Settlement and custody, however, happen on Paradex’s private Starknet L2 appchain, where zero-knowledge STARK proofs ensure verifiability and privacy. Funds bridge in and out via Ethereum (L1), so users remain in full control of their assets, with no custodial risk, no central point of failure.

The New News

For former Vertex traders who valued advanced instruments, Paradex offers perpetual futures with up to 50x leverage, and perpetual options with even higher leverage, without liquidation risk. There's also a unified margin, meaning you can manage all trades from one account, boosting capital efficiency. Add to that the Gigavault (which earns ~30% APR), XP rewards that could tie into future $DIME airdrops, and gas-efficient cross-chain trading, and you’ve got a platform built to not just replace Vertex but outperform it.

In short, Paradex doesn’t just fill the void left by Vertex; it pushes the boundaries of what decentralized trading can be.

In the spirit of community and resilience, Paradex stepped up to support those impacted by Vertex’s shutdown with a dedicated recovery campaign. Paradex is here to help traders get back on their feet with no judgment, just genuine support.

As part of this initiative, eligible traders will receive a 50% discount on taker fees, capped at $20 million in taker volume, making it easier to re-enter the market without heavy cost friction. On top of that, Paradex is doubling the rewards with a 2x XP boost on up to 5,000 XP earned, helping you climb the ranks faster and tap into upcoming airdrops and incentive programs.

This campaign will run for two weeks, starting July 14, 2025, and is open to anyone who deposited the Vertex Endpoint contract between January 1, 2023, and July 11, 2025. Naturally, to maintain the integrity of the program, Sybil addresses will be filtered out to ensure rewards go to real, active users.

Whether you're a seasoned trader or just finding your way back, Paradex is here to offer a fresh start, and perhaps something even better than before.

Conclusion

What happens next in the decentralized trading wars? That’s anyone’s guess. The “Hyperliquid effect” has already shaken the market, with its 70–75% dominance in perp DEX volume contributing to the unexpected shutdown of Vertex Protocol in July 2025. Will other platforms follow? Will consolidation accelerate? Or will new players rise with better speed, liquidity, and user incentives?

Only time will tell. Amidst all this uncertainty, Paradex is making a compelling case for itself, offering CEX-like performance on Starknet, ZK-encrypted privacy, and innovations such as Retail Price Improvement and perpetual options with no liquidation risk. As the dust settles, the question isn’t just who survives, but who adapts fast enough to lead.